Updated Report: Illinois Oil Reserves Generated $108.6M in Local Property Tax Revenue From 2007-2021

Many Illinoisans may not be aware that the state’s active oil production leases are assessed and taxed as real estate, similar to property taxes paid on a residential home. All of the revenue collected from this tax – known as an ad valorem tax – stays at the local level and goes directly to support the areas where oil is produced, including counties, villages, townships, cities, and – most importantly – local schools.

An IPRB review of the latest Illinois Department of Revenue (IDOR) data shows that Illinois oil reserves generated $108.6 million in ad valorem tax revenue from 2007 to 2021, an average of more than $7.24 million per year. IPRB details this revenue in an updated annual report that can be downloaded here and by clicking the image below.

IDOR data also show that nearly 60 percent of this $108.6 million in revenue went to fund K-12 public schools near production. For this year’s report, IPRB downloaded the exact percentage of ad valorem revenue that went toward K-12 public schools near production for each year of the report (2007-2021) in each producing county, finding approximately $64.8 million of the total $108.6M in ad valorem tax revenue collected from 2007-2021 went to fund K-12 public schools in producing counties. This is upwardly revised from IPRB’s previous reports (2019, 2020, 2021 and 2022), which had conservatively estimated 50 percent of the total oil reserve ad valorem revenue collected went to K-12 public schools near production.

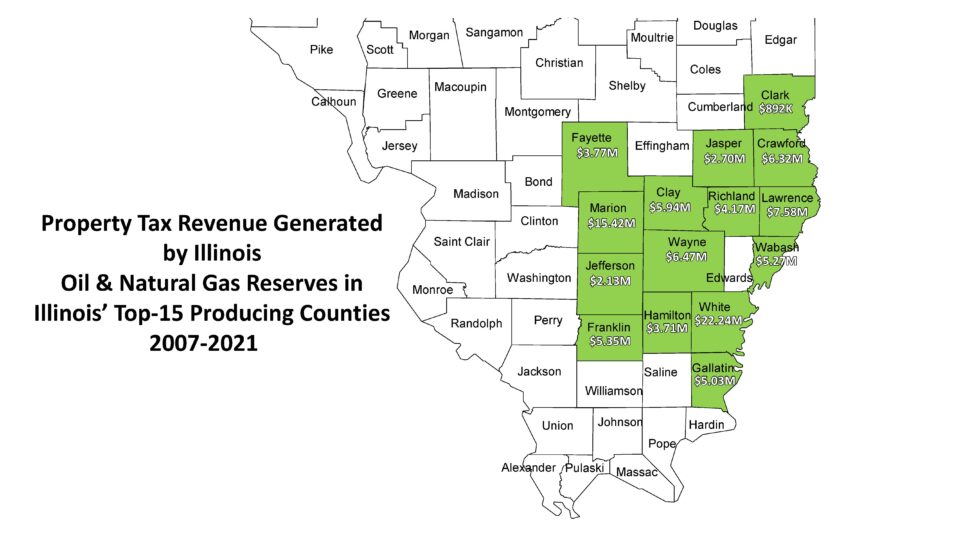

Ad valorem tax revenue from Illinois oil production has a particularly significant impact in major producing counties. IDOR data show that ad valorem tax revenue in Illinois’ top-15 oil producing counties totaled $97.05 million from 2007-2021, an average of more than $6.47 million per year. See the graphic below for revenue totals in each of the state’s top-15 oil producing counties.

IPRB estimates that approximately $57.88 million of that revenue went to K-12 public schools in those top-15 producing counties.

It is important to note that many of these counties have relatively small populations and are relatively poor compared to many other state counties and the state as a whole. In fact, all but one of Illinois’ top oil producing counties (Crawford) have poverty rates that are higher than the national average – adding even more significance to the ad valorem tax revenue generated by oil and natural gas reserves in these counties. Just two percent of Illinois’ overall population resides in these top-15 producing counties, which are responsible for 90 percent of Illinois oil production.

County-level reports for each of Illinois’ top-15 producing counties can be downloaded at the links below. An example of the county-level reports can also be viewed below.

- White County

- Marion County

- Crawford County

- Lawrence County

- Fayette County

- Wabash County

- Wayne County

- Franklin County

- Clay County

- Richland County

- Hamilton County

- Clark County

- Jasper County

- Gallatin County

- Jefferson County

It is important to understand that these taxes are based on estimates of oil and gas reserves remaining in the ground, not oil and natural gas produced. The annual ad valorem tax bill that operators and royalty owners receive is also based on data that is over two years old. For example, ad valorem taxes paid in 2017 were based on a 2016 assessment of active leases that is calculated using 2015 production totals. There are also reductions for leases based upon lease age, secondary recovery methods used and production.

As complicated as the ad valorem tax calculation system may be, it is clear that these taxes are generating significant revenues in the communities where they operate, specifically for local schools.