Five Reasons Pump Prices Are So High in Illinois

Why are pump prices SO high right now – especially here in Illinois? There are a myriad of reasons, many of which have nothing to do with Russia’s invasion of Ukraine and the subsequent U.S. ban on Russian energy imports. Here the top five reasons pump prices are at record highs.

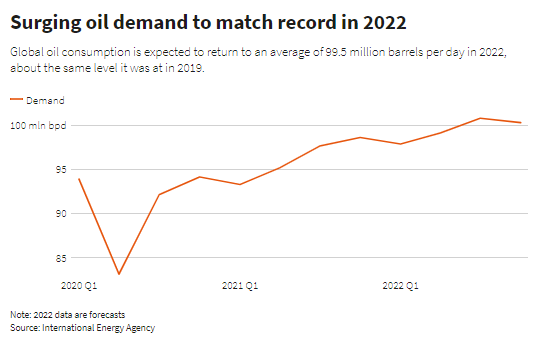

- First and foremost, oil demand is off the charts. U.S. oil demand recently hits an all-time record for this time of year of 22 million barrels per day. Global demand is near pre-pandemic record highs as well.

- Oil supply is unable to meet current demand. The Environmental, Social and Corporate Governance (ESG) movement has driven new oil and gas investment down 50% since 2011. Coupled federal policies aimed at discouraging oil and natural gas development, this has kept U.S. production below pre-pandemic levels.

- OPEC+ has also failed to meet its recent production quotas and it’s been widely reported that the cartel’s spare capacity could be exhausted by the end of the year. Coupled with stagnant U.S. production, this has left the global market undersupplied. This directly impacts pump prices, which are driven largely by the global market.

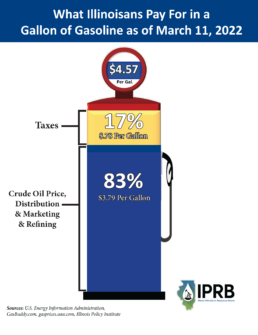

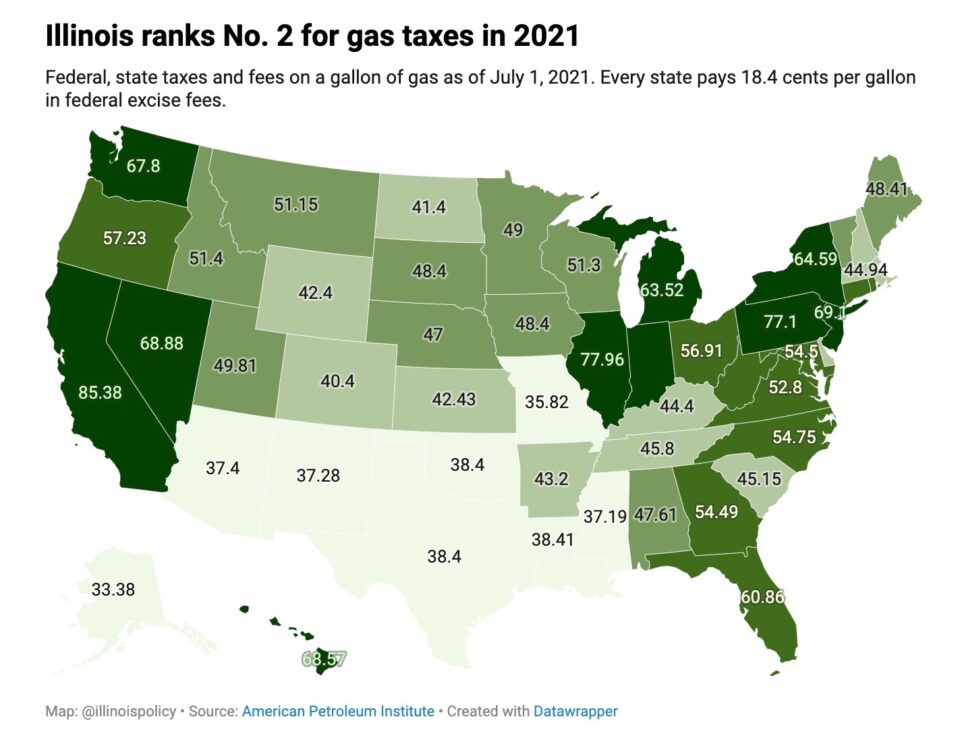

- At the regional level, Illinois’ gasoline tax burden – totaling 78 cents per gallon when state, federal and local taxes are added up – is the second-highest in the country. This explains why gasoline is so much cheaper across the border in Missouri, Wisconsin, Indiana and Kentucky.

- Russia’s invasion of Ukraine – and subsequent bans on Russian energy imports – has piled on top of the aforementioned factors to send pump prices soaring past the $4 threshold. The removal of barrels from the world’s second-leading oil producer and exporter has sent an already undersupplied global market into disarray. Notably, pump prices would soar to unthinkable levels should European nations such as Germany ban Russian energy imports. However, most European nations are so overly reliant on Russian oil and natural gas that they will likely NOT impose formal sanctions on Russian energy.

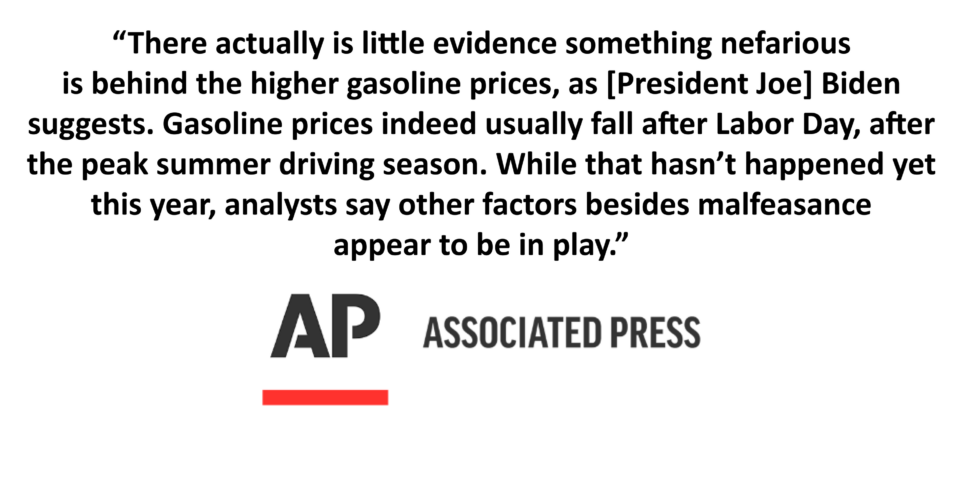

President Biden has suggested price gouging is to blame for rising pump prices, but a September Associated Press fact check debunked that claim.

Oil is a globally traded commodity and oil companies have no control over the price of oil or gasoline prices. If they did, they certainly would have never let oil prices go negative like they did last spring when the Covid-19 pandemic sent oil demand plummeting.

Although Illinois has the potential to produce more oil than it’s currently producing, Illinois producers also have no control over pump prices. Illinois produces between 20,000-21,000 barrels of oil per day and the world consumes 100 MILLION barrels per day. However, increased United States production can help lower pump prices and improve our energy security. Even Tesla founder and CEO Elon Musk has called for increased U.S. oil and natural gas production to deal with this crisis, indicating that not even he believes this issue can be resolved by Americans simply going out and buying electric vehicles.

The United States will need to increase all forms of domestically produced energy to blunt the impacts of this crisis. Fortunately we are in much better shape than the European Union, which is dangerously reliant on Russia for its energy needs and also overly dependent on weather-reliant alternative sources that have left it vulnerable to Vladimir Putin's aggression.

Illinois Crude Oil Production Totaled Just Under 7.4 Million Barrels in 2021

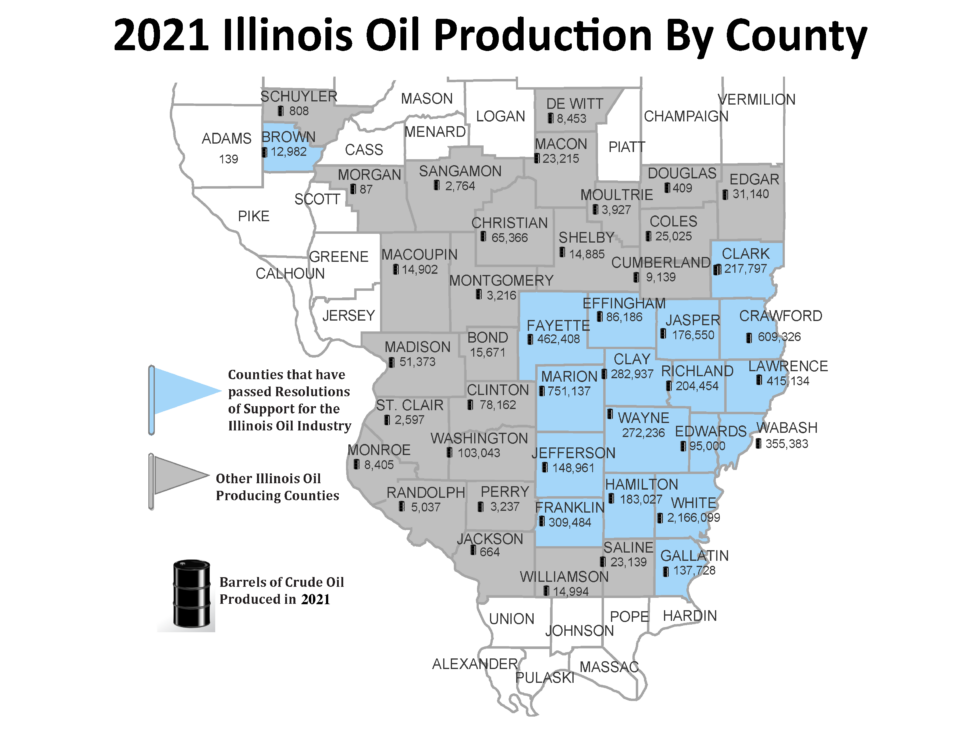

Illinois crude oil production totaled 7,397,119 barrels in 2021, according to data compiled by the Illinois Petroleum Resources Board (IPRB) that is based on first-purchaser reports. Click here to download IPRB’s annual Illinois oil production report.

The state’s 2021 production was slightly below 2020 levels (7,513,835), as extreme cold weather in February and labor shortages throughout the year were factors in production remaining 1.5 percent below last year’s levels despite a strong rebound in oil prices following the demand-driven crash brought on by the Covid-19 pandemic.

Several counties did see increased production compared to 2020 levels, most notably Franklin County, which saw its production jump 19 percent to 309,484 barrels. Crawford County saw the second-largest year-over-year increase (+23,600 barrels), while Macon, Jefferson, Christian, Clay, Richland and Clinton counties also saw significant production increases compared to 2020.

White County remained by far Illinois’ top producing county, totaling 2,166,099 barrels of production in 2021, representing better than 29 percent of the state’s overall production.

White County surpassed 2 million barrels of production for the third straight year and its annual production has more than doubled from levels seen just a decade ago.

The state’s top-15 producing counties – White, Marion, Crawford, Fayette, Lawrence, Wabash, Franklin, Clay, Wayne, Clark, Richland, Hamilton, Jasper, Jefferson and Gallatin – collectively produced 90.5 percent of the state’s oil in 2021. All 15 of those counties – as well as Edwards, Brown and Effingham counties – have recently passed Resolutions of Support for the Illinois oil production industry.

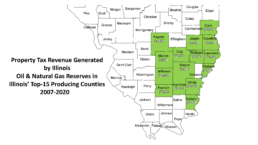

Updated Report: Illinois Oil Reserves Generated $104.5M in Local Property Tax Revenue From 2007-2020

Many Illinoisans may not be aware that the state’s active oil and natural gas production leases are assessed and taxed as real estate, similar to property taxes paid on a residential home. All of the revenue collected from this tax – known as an ad valorem tax – stays at the local level and goes directly to support the areas where oil is produced, including counties, villages, townships, cities, and – most importantly – local schools.

An IPRB review of the latest Illinois Department of Revenue (DOR) data shows that Illinois oil reserves generated $104.5 million in ad valorem tax revenue from 2007 to 2020, an average of more than $7.46 million per year. IPRB details this revenue in an updated annual report that can be downloaded here and by clicking the image below.

IPRB also explains in the following video how this tax revenue helps communities where oil and natural gas are produced.

Typically, at least half of ad valorem property tax revenue is used to fund public education, while the remaining monies are used to fund various local public services. That fact noted, IPRB conservatively estimates that Illinois oil reserves generated at least $52.25 million in ad valorem tax revenue for schools in producing counties from 2007-2020. This revenue is all the more significant considering Illinois public schools were woefully underfunded by the state during this time frame, placing even more burden at the local level.

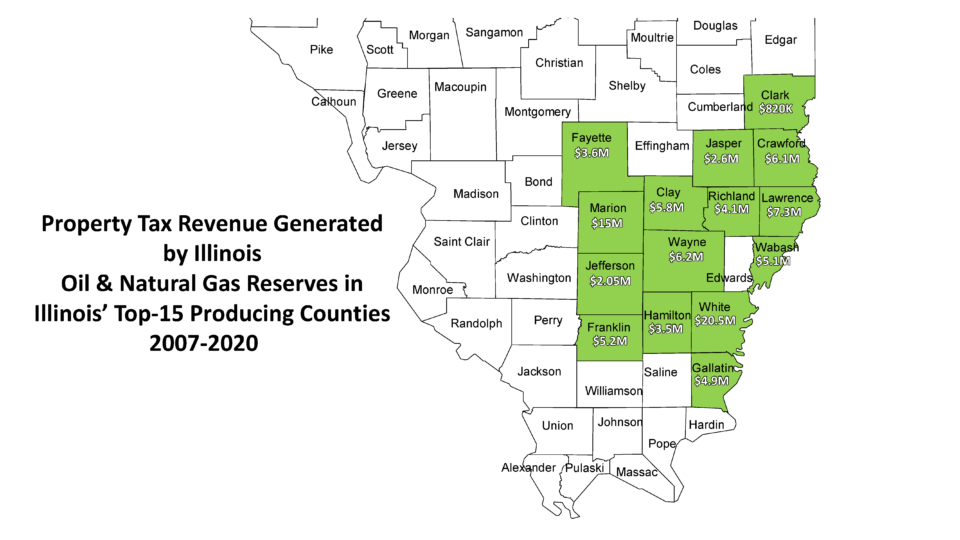

Ad valorem tax revenue from Illinois oil production has a particularly significant impact in major producing counties. IDOR data show that ad valorem tax revenue in Illinois’ top-15 oil producing counties totaled $93.16 million from 2007-2020, an average of more than $6.65 million per year. See the graphic below for revenue totals in each of the state's top-15 oil producing counties.

IPRB conservatively estimates that at least $46.58 million of that revenue went to public schools in those top-15 producing counties.

It is important to note that many of these counties have relatively small populations and are relatively poor compared to many other state counties and the state as a whole. In fact, all but one of Illinois’ top oil producing counties (Crawford) have poverty rates that are higher than the national average – adding even more significance to the ad valorem tax revenue generated by oil and natural gas reserves in these counties. Just two percent of Illinois’ overall population resides in these top-15 producing counties, which are responsible for 90 percent of Illinois oil production.

County-level reports for each of Illinois’ top-15 producing counties can be downloaded at the links below. An example of the county-level reports can also be viewed below.

- White County

- Marion County

- Crawford County

- Lawrence County

- Fayette County

- Wabash County

- Wayne County

- Clay County

- Franklin County

- Richland County

- Clark County

- Jasper County

- Hamilton County

- Gallatin County

- Jefferson County

It is important to understand that these taxes are based on estimates of oil and gas reserves remaining in the ground, not oil and natural gas produced. The annual ad valorem tax bill that operators and royalty owners receive is also based on data that is over two years old. For example, ad valorem taxes paid in 2017 were based on a 2016 assessment of active leases that is calculated using 2015 production totals. There are also reductions for leases based upon lease age, secondary recovery methods used and production.

As complicated as the ad valorem tax calculation system may be, it is clear that these taxes are generating significant revenues in the communities where they operate, specifically for local schools.

Importance of Affordable, Reliable Energy Cannot Be Overstated

Affordable, reliable energy. It’s something we all depend on. And it’s something most Americans have probably gotten used to taking for granted. That was especially true from about 2009 to 2019, as record U.S. oil and natural gas production led to energy costs dropping sharply at the same time food, education and healthcare costs soared.

But that changed in a big way last year, as policies aimed at decreasing traditional American energy production and distribution contributed to energy costs soaring more than 33 percent.

As a result, two in 10 American households couldn’t pay at least one monthly energy bill in full. Another 18 percent kept the temperature in their home at an unhealthy or unsafe level. And more than a quarter of Americans sacrificed food or medicine in order to pay an energy bill.

These are disturbing and potentially deadly trends during frigid winter months for the more than 1 ½ million Illinoisans living below the poverty line who were already spending about a quarter of their income on energy costs before prices spiked last year. One in three U.S. households were already struggling with household energy insecurity, meaning that although they have adequate access to energy, they oftentimes can’t afford it.

The fact that household energy insecurity is now sharply trending in the wrong direction shows that although policies aimed at addressing climate change are well-intended, their unintended side effects could be more damaging than the issues they are intended to address. The myth that weather-dependent energy sources such as wind and solar are cheaper for consumers is being thoroughly debunked in real-time. Since wind and solar are intermittent energy sources, they require almost 100 percent redundant traditional energy backup and expensive storage to be even remotely reliable. The added expense is passed on to consumers. If you are skeptical, check out energy costs in “green” Germany.

Germany’s retail electricity costs were already nearly three times higher than the United States’ before Europe’s current energy crisis began, with half of the average German electricity bill comprised of taxes, levies and charges to pay for renewable energy build-out known as “Energiewende.” Reuters recently reported that a soon-to-be-released government audit finds Germany’s renewable energy transition “has left Germany with Europe’s highest retail electricity prices and at risk of grid blackouts.”

But the worst may be yet to come.

Germany and the rest of the European Union is currently dangerously dependent on Russia for its oil and natural gas needs and these countries are paying unprecedented prices as a result. Natural gas prices are about five to 10 times higher in Europe than they are here. In absence of access to adequate natural gas and wind generation, so-called “green” European countries are even burning record amounts of coal, laying to waste the greenhouse gas reduction ambitions that were the justification for their unrealistic “green” policies in the first place.

It boils down to this: In the real world, access to affordable, reliable energy is a far bigger priority than idealistically driven renewable energy campaigns that deliver neither. Not only will the so-called “energy transition” – which is essentially a transition from a hydrocarbon-fuel energy system to a metal commodity-based energy system – not happen overnight, it will likely take decades. We don’t currently have the battery technology needed to make wind and solar reliable or access to the quantity of minerals needed to do anything more than merely supplement exploding energy demand growth. We will need a lot of oil, natural gas and other traditional energy sources for many decades to come in order to keep energy reliable and affordable and minimize energy insecurity.

This will require a true all-of-the-above approach that, combined with advancements in carbon capture and sequestration technologies, can allow us to continue leading the world in greenhouse gas reductions and avoid the climate regression and geopolitical nightmare Europe faces. As pump prices continue trending toward $4 a gallon and utility bills follow a similar trajectory, here’s to hoping policies focused on lowering energy costs and allowing the United States to regain its hard-fought energy independence are prioritized.

*UPDATE* Strong U.S. Oil and Gas Production Keeps Energy Costs Affordable

UPDATE: Jan. 14, 2022

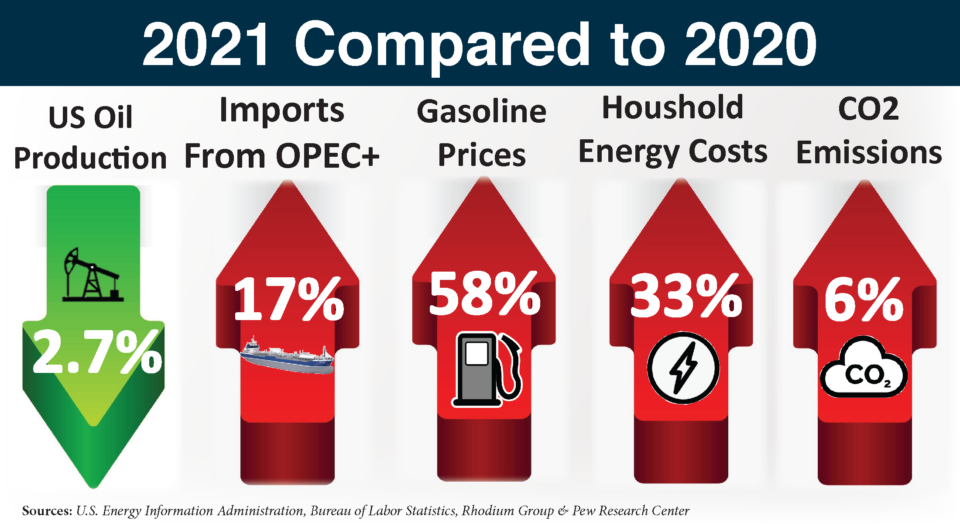

Numerous recent reports show that energy costs increased dramatically in 2021, as U.S. oil and natural gas production was unable to keep up with surging demand.

CNBC reported in December that the most recent Bureau of Labor Statistics data show that energy prices increased 33.3 percent in 2021. Gasoline prices specifically were up a whopping 58 percent in 2021, according to the Pew Research Center.

The sudden and sharp increase in energy costs after more than a decade of consistent declines has taken a heavy toll on American households, particularly low-income families. CNBC reported that a recent study by Help Advisor finds that 20 percent of Americans couldn’t pay at least one monthly energy bill in full last year, while 18 percent kept the temperature in their home at an unhealthy or unsafe level. More than a quarter of Americans sacrificed food or medicine in order to pay an energy bill, according to the Help Advisor report.

Ironically, policies aimed at decreasing U.S. oil and natural gas production in an effort to lower greenhouse gas emissions actually contributed to a six percent jump in carbon dioxide (CO2) emissions, as utilities burned more coal due to less plentiful and more expensive natural gas.

As the Rhodium Group concluded in a December report:

“GHG emissions rebounded slightly faster than the overall economy in 2021, largely due to a jump in coal-fired power generation…

“With only modest growth in overall electric power demand in 2021 (up 3% from 2020), the more robust growth in power sector GHG emissions was due to a sharp rise in coal generation, jumping 17% in 2021.”

UPDATE: June 3, 2020

A new Consumer Energy Alliance (CEA) report finds record U.S. natural gas production saved Illinois consumers $24 billion from 2007 to 2017, an average savings of $876 for every resident in the state. The report also finds that residential natural gas prices in Illinois were 25 percent lower in 2017 than they were 10 years prior, due largely to a dramatic increase in domestic production over that time-frame.

According to the report, roughly 1.6 million Illinoisans who are living below the poverty line spend about a quarter of their income on energy costs, placing added significance to the savings that have been made possible by cheap and abundant natural gas. The CEA finds that 80 percent of Illinois households use natural gas to heat their homes during the winter and that natural gas is also essential to the agricultural, manufacturing and utility sectors.

Check out a fact sheet on the report here.

Original Post: April 15, 2020

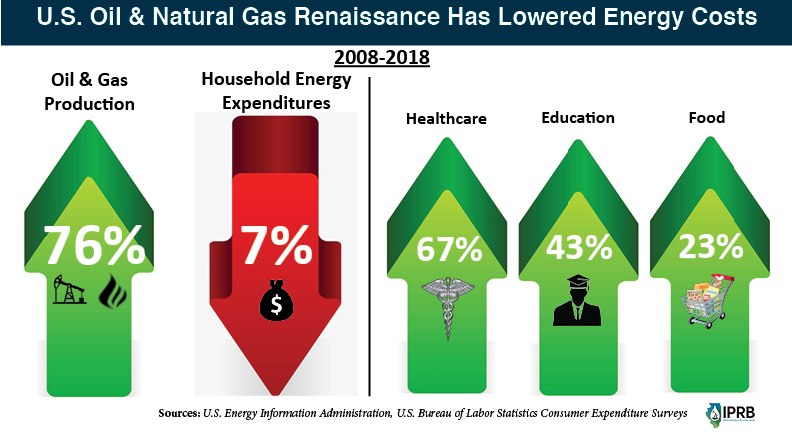

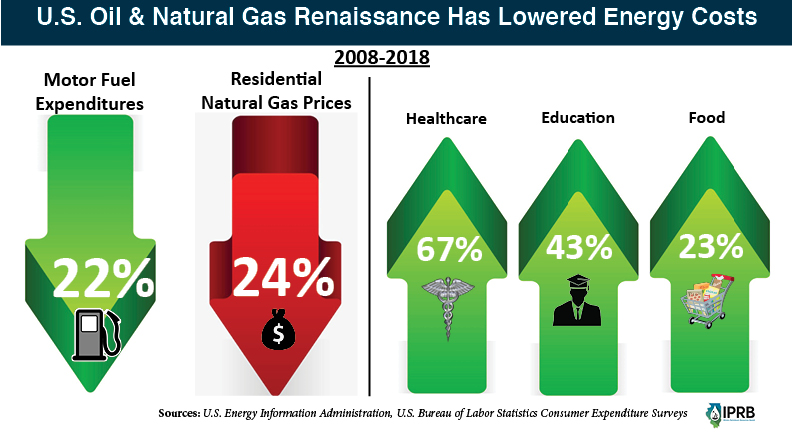

The cost of living in the United States has increased across the board over the past decade, with one notable exception. At the same time healthcare, education and food costs have exploded (see graphic below), the most recent government data show household energy costs – including utilities and expenditures on transportation fuels – were down just under seven percent from 2008 levels in 2018, the latest year in which data is available.

Considering 68 percent of America’s energy needs are met by oil and natural gas, the decline in overall energy costs can be traced to the fact that domestic oil and natural gas production increased 76 percent during that time-span.

As a result, the typical American family of four has saved $2,500 per year, according to the White House Council of Economic Advisers. Those savings make a huge difference for low-income households, which have historically spent a disproportionate amount of their incomes on energy, making energy price spikes disproportionately impactful as well (more on that in a bit).

Access to affordable and abundant energy is a fundamental need – and the U.S. oil and natural gas industry has met that need in a big way, reversing a troubling trend in the process.

Back in 2008, talk of “peak oil” and “peak gas” was commonplace. Domestic production was perceived to be in irreversible decline and imports were surging to all-time highs. Not coincidently, U.S. energy costs “reached their highest point on record in 2008, when they averaged $24.13 per million Btu,” according to a 2018 U.S. Energy Information Administration (EIA) report.

But thanks largely to industry innovation, the United States is now the world’s largest oil and natural gas producer, and energy costs have plummeted as a result. The EIA reported that in 2016, U.S. energy costs fell to a “record-low energy expenditure share,” adding:

“The U.S. average energy price was $15.92 per million British thermal units (Btu) in 2016, down 9% from 2015, and the lowest since 2003, when adjusted for inflation.”

U.S. households today spend less than four percent of their total budgets on energy costs, down from 5.1 percent a decade ago. Gasoline prices are currently about half of the record-high costs seen in 2008 and have averaged below $3 a gallon for six straight years, while retail natural gas prices declined 24 percent from 2008 to 2018.

However, oil and natural gas bans and restrictions being proposed by mainstream political factions pose a real threat to energy access and affordability moving forward. Such policies would negatively impact a large portion of the population if implemented.

A 2018 Energy Information Administration (EIA) report reveals that one of three U.S. households struggle with household energy insecurity, meaning that although they have adequate access to energy, they oftentimes can’t afford it. In fact, 25 million Americans report they’ve had to choose between energy and food or medicine in 2018, while 14 percent of those surveyed reported they had recently received a disconnection notice.

It is with those facts in mind that several civil rights leaders have advocated for access to natural gas for low-income minority communities, in addition to declining to endorse bans on hydraulic fracturing. As Axios recently reported:

“Revs. Al Sharpton and Jesse Jackson and National Urban League President Marc Morial said energy costs are hitting people of color unfairly hard. These concerns, expressed before the coronavirus pandemic, are poised to expand as paychecks shrink across America.”

As Energy In Depth recently highlighted, Rev. Jackson has worked with local officials in the Pembroke Township community of Hopkins Park – one of Chicago’s poorest suburbs – to bring a natural gas line to the community. The median income in this Chicago suburb is just $16,000 per year and residents have relied primarily on propane and wood stoves for home heating during the region’s often brutal winters.

As Energy In Depth noted, “Why natural gas? Households that use natural gas saved more than $4,000 over a 10-year period, according to a recent study by Shale Crescent USA and the Ohio Oil & Gas Energy Education Program. Low income households, which spend a disproportionate amount on energy, realized savings equal to 2.7 percent of their annual income.”

Hopkins Park Mayor Mark Hodge said in a recent TV interview that:

“This community has been overlooked for the past 48 years for natural gas, so we’re in need of industry and we’re in need of jobs, and our school is in need of natural gas.”

In the real world, access to affordable, reliable energy is a far bigger priority than idealistically driven renewable energy campaigns that deliver neither. Fortunately, America’s oil and natural gas industry is meeting those fundamental needs.

Fast Fact Sheet: Petroleum Essential to Modern Healthcare

Perhaps the most essential use of petroleum is modern healthcare. Here are few examples.

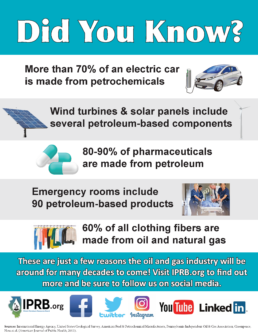

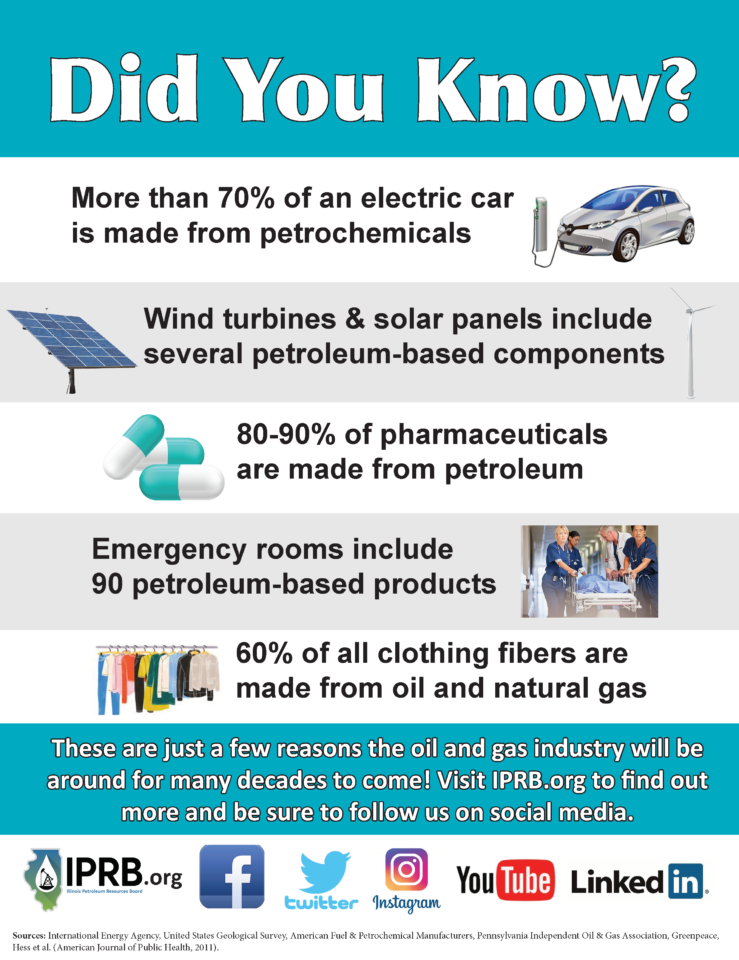

Even More Reasons We Need Oil

Reports that we don’t need oil anymore couldn’t be further from the truth. Here are a few reasons why.

Fast Fact Sheet: More Reasons We Need Oil

Reports that we don’t need oil anymore couldn’t be further from the truth. Here are a few reasons why.

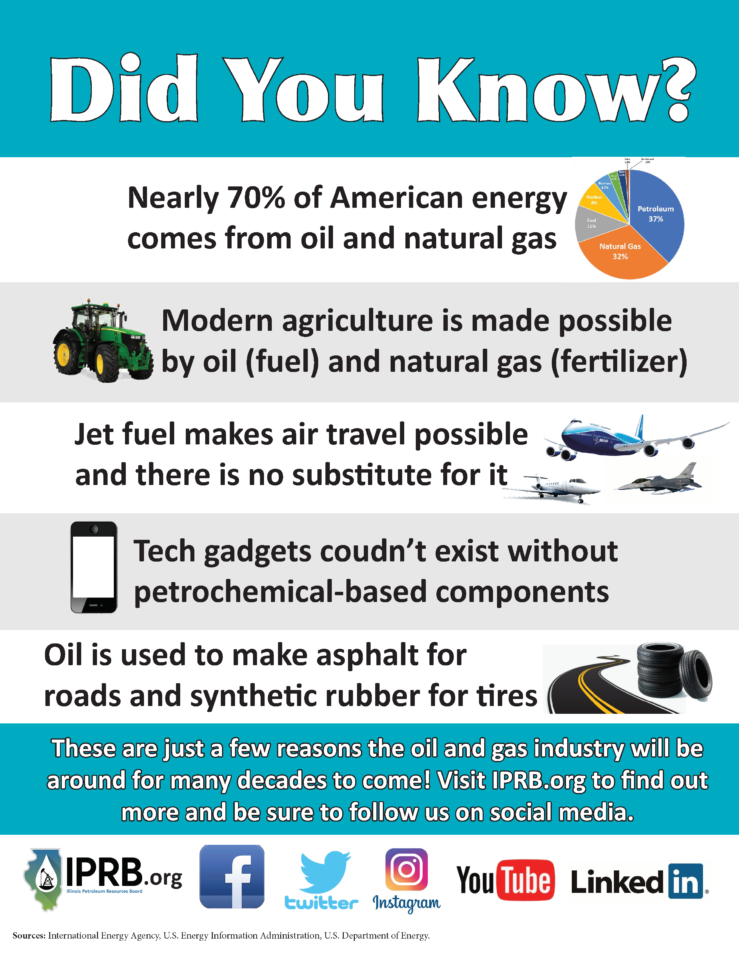

Fast Fact Sheet: Why We Need Oil

Reports that we don’t need oil anymore couldn’t be further from the truth. Here are a few reasons why.

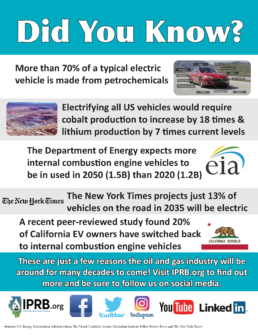

5 Fast Facts About Electric Vehicles

Reports that electric vehicles will make oil obsolete are greatly exaggerated. Here are a few reasons why.