Diesel: The Underappreciated Lifeblood of Our Economy

With talk of possible diesel shortages making news this fall, it can’t be emphasized enough that the fuel is one of the most essential products in the world today. That might sound like hyperbole, but you don’t have to take the oil industry’s word for it.

According to the Biden administration’s Energy Information Administration, diesel engines power “most of the farm and construction equipment in the United States” and “help transport nearly all products people consume.” In other words – we can’t live without it. The undeniable necessity of the fuel is just one example of why the push to rapidly curtail U.S. petroleum production is so misguided. At worst, hundreds of millions would starve without diesel. At minimum, we would not be able to enjoy the vast array of modern products and conveniences we take for granted.

There are many reasons the United States’ transportation, healthcare, mining, construction and agricultural sectors use more than 46 billion gallons of diesel a year combined: it’s exceptionally energy-dense and reliable, and diesel engines are built to do the heavy-duty work that keeps America going.

Anyone who’s spent any time lately on our interstate highways or has had packages delivered to their doorstep can surely understand the importance of the fuel for use in over-the-road trucks alone. The U.S. Census Bureau’s Commodity Flow Survey shows that more than 71 percent of all goods shipped in the United States are transported by predominantly diesel-powered trucks, a figure that is only increasing.

What about the other 29 percent of goods shipped? Diesel also powers the freight trains, boats and barges that move products around the globe, accounting for the lions’ share of that remaining percentage.

Diesel-powered combines, tractors and other agricultural implements also make it possible to produce enough food to feed the world’s exploding population, while diesel-powered heavy equipment make the mining and construction that serve as the backbone of society possible. Hospitals also rely on backup diesel generators to provide continuous electricity even in the event of outages, literally saving lives.

But what about electrification? Won’t that make diesel fuel obsolete? Although electric passenger vehicles are becoming more common, our fleet of diesel-powered vehicles and equipment won’t be electrified any time soon. We need diesel. Lots of diesel. And we’re already seeing the consequences of allowing supply to wane.

U.S. diesel inventories have sunk to their lowest levels for this time of year on record. Although rumors that we are running out of diesel have been exaggerated, the supply-demand imbalance has driven prices well over $5 per gallon and prices are likely to soar even higher this winter. These elevated transportation costs for virtually all the products we consume will also likely continue to drive up the retail costs of these goods.

One of the primary reasons diesel prices have spiked is because U.S. refining capacity is down more than one million barrels per day from pre-Covid levels. Some refineries went out of business during the pandemic, while others succumbed to political and social pressure to focus on producing more “green” fuel alternatives. Most of the country’s 135 refineries are producing as much diesel as physically possible at the moment, but the fact remains that demand – driven by all of the diesel end-uses listed above – is outpacing their ability to supply the market. The loss of Russian barrels in response to Vladimir Putin’s invasion of Ukraine has only exacerbated this problem.

That’s why it’s imperative moving forward that we see a sincere bipartisan commitment to not only increase domestic oil production but up our refining capacity as well. That will require a shift in the hostile policies and contradictory rhetoric that has deliberately and successfully been aimed at discouraging investment. After all, the United States needs diesel fuel, along with a number of other essential petroleum products. Those who remain skeptical of those facts will likely learn the cold, hard facts this winter.

Illinois Oil Producers Doing Good Work In Their Communities

**UPDATED on May 2, 2025**

If you are a “downstate” Illinoisan, you have probably seen a pump jack or two nodding up and down somewhere near where you live and are aware there is significant oil production in the state. But a lot of Southern Illinoisans may not know that almost all the folks that drill and pump those oil wells that dot the countryside live in the same communities where they produce. The complete opposite of “Big Oil,” most Illinois oil producers are your neighbors and fellow small business owners. And a vast majority of those local oil producers are also doing good things in their respective Southern Illinois communities. Here are just a few examples.

C.E. Brehm

A record three-time recipient of the Illinois Oil and Gas Association’s Wildcatter of the Year award, the late C.E. Brehm was a legend of the Illinois oil production industry, most known for his uncanny ability to find oil. But he was also a great philanthropist.

Brehm’s most notable contribution to his beloved community of Mt. Vernon was a $300,000 donation in 1978 to expand the Mt. Vernon Public Library. The library was required to raise the matching funds by December 1980. Unfortunately Mr. Brehm died on July 9, 1980, but the library board was able to match the funds on Oct. 31 and the city council renamed the Mt. Vernon library the C.E. Brehm Memorial Library on November 3, 1980. Groundbreaking ceremonies were held on May 16, 1981 and the addition was completed 1982. The expansion and upgrades included two additional wings to the library as well as an elevator and parking lot.

The library remains a community fixture along Illinois Highway 15 on the eastern edge of Mt. Vernon. In 1989, voters of the three townships approved a referendum to create the C.E. Brehm Memorial Public Library District.

Mr. Brehm also established the Brehm Foundation, which has given dozens of scholarships to high school graduates.

As one of Brehm’s longtime employees wrote in 2019, Mr. Brehm “did many acts of kindness that received no publicity.”

Campbell Energy

Carmi-based Campbell Energy – the largest oil producer in the Land of Lincoln – recently received the Carmi Chamber of Commerce “Business of the Year” award in recognition of its service to the White County community.

Jake Campbell and John Campbell of Campbell Energy receive the Carmi Chamber of Commerce "Business of the Year" award.

As former Carmi Chamber president Amber Knight said prior to presenting Campbell Energy with the honor, “This company generously gives to many, many causes in White County. Their name can be seen on the backs of our kid’s uniforms, on banners for events and festivals and helping to keep some of our youth programs alive by donating money and equipment with no recognition at all. The impact that their existence has on our county can be seen in our economy, in our workforce and in our youth.”

Most notably, Campbell Energy recently provided funds and manpower to renovate an abandoned Carmi building into a community youth center.

404 Seed Station Youth Center Computer Lab

Just up the road in Fairfield, Podolsky Oil Company has been giving back to the Wayne County community for years through the Bernard and Naomi L. Podolsky Charitable Trust. The trust has made it possible for more than 900 Wayne County high school seniors to visit Washington D.C. over the past decade, covering roughly 60 percent of the annual trip’s expenses. This has allowed many kids who would otherwise not be able to afford such a trip to visit historical sites such as the Washington Monument, the Lincoln Memorial, the United States Holocaust Memorial Museum and Arlington National Cemetery, just to name a few.

Late Podolsky Oil founder Bernard Podolsky and son and current company president Michael have also been recognized for their various conservation endeavors, most notably earning former Gov. Jim Edgar’s “Illinois Outstanding Tree Farmer of the Year” award in 1991.

Deep Rock Energy

Just a little more up the road, Marion County-based Deep Rock Energy has contributed generously to the Kinmundy community in numerous ways, most visibly by largely funding and providing labor and expertise to construct a first-class youth softball facility and playground in the community.

Built on an eight-acre plot near South Central Elementary School, Webster Family Park features two softball fields and a playground. Prior to its construction, there was no softball field in Kinmundy and the community’s school and traveling teams were relegated to taking grounders in the Kinmundy United Methodist Church parking lot. Now, Kinmundy hosts several traveling team softball tournaments a year and its first-class facility has helped the South Central high school program emerge as a regional champion.

“I can’t say enough about what the Webster family has done and we wouldn’t have close to what we have without them,” Kinmundy Area Sports and Youth Opportunities Corporation board member Shawn Garrett said.

Overall Industry Contributions

Collectively, all but one of Illinois’ 1,500-plus oil producers voluntarily contributes to the Illinois Petroleum Resources Board’s (IPRB) abandoned tank battery reclamation program. These voluntary industry funds have allowed IPRB to clean up more than 500 abandoned tank battery sites throughout state at no cost to landowners or taxpayers, improving the landscape while safeguarding the environment.

To be clear, an overwhelming majority of Illinois oil producers are responsible and properly remove oilfield infrastructure once their leases are no longer commercially productive. But there are some instances in which sites are abandoned for various reasons, most often because the responsible party has passed away. In response, the industry has collectively and proactively stepped up by contributing to this IPRB program that addresses these sites.

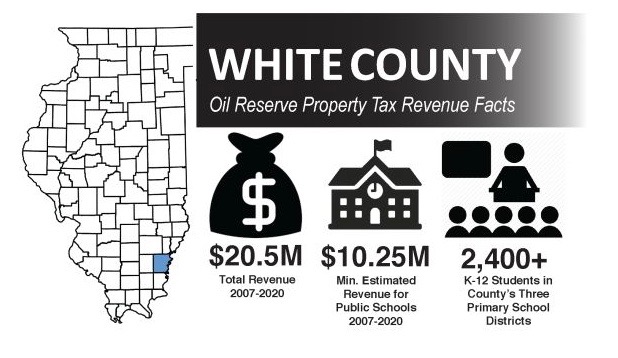

Illinois oil producers also contribute to their local communities via annual property taxes on oil reserves known as the ad valorem tax. Those taxes have generated an average of $7.4 million in local tax revenue per year since 2007. This revenue stays in producing counties, going to fund local municipalities and public services. Most notably, more than half of that revenue goes to fund public schools that are located near production sites.

So next time you see a pump jack or tank battery as you’re driving around Little Egypt, keep in mind that it is not only likely those oil production facilities are owned and operated by fellow Southern Illinoisans, but that those local oil operators are contributing to your local community in ways most are not aware of. Because they live, work and play on the same land as they produce on, a vast majority of Illinois oil producers proudly give back to their communities in a myriad of ways.

Campbell Energy Recognized For Community Service

Note: This blog post was updated on Oct. 7, 2022

The Illinois oil patch is unique in that almost all its producers not only live and work in the communities where they operate but are very active in those local communities as well. A shining example is Campbell Energy in Carmi, which was recognized for its community service and business success this week by receiving the 2022 Carmi Chamber of Commerce Business of the Year Award.

Campbell Energy Co-Founders Jake and John Campbell

“We are very fortunate to be a part of this community,” Campbell Energy co-founder and CEO Jake Campbell said after being presented the award. “We employ 115, 120 people from the area and we can’t do what we do without those 115, 120 people. We are very fortunate to have them, to retain them, to keep them and to keep finding new people to come in and help us.

"Receiving this honor at the Chamber dinner is a reflection of all 115 of us. We have been so blessed with the ability to work with such great people. It takes all 115 of us to make it work. What we have been blessed enough to do for the community also comes from all the hard work that all 115 of us do every day. So this award presented to us, from my perspective, is an award that is presented to all 115 and a testament of the work ethic and great job each and everyone does day in and day out. I am very appreciative, thankful, and blessed to work with such great people."

Campbell Energy’s business success is well known. The company has grown from producing less than 10 barrels per day in 2007 to being Illinois’ largest oil producing company at more than 4,000 barrels of production per day in 2022. Not only does Campbell Energy directly employ more than 115, it supports hundreds more jobs when the oil and gas industry’s jobs multiplier is taken into account (Every direct oil and gas job indirectly supports 5.43 other jobs, according to the Economic Policy Institute).

But less understood and just as impressive as the company’s business success is its contributions to the White County community – all of which were huge considerations to it receiving this honor.

“This company generously gives to many, many causes in White County,” former Carmi Chamber of Commerce president Amber Knight said prior to presenting Jake Campbell with the honor. “Their name can be seen on the backs of our kid’s uniforms, on banners for events and festivals, and helping to keep some of our youth programs alive by donating money and equipment with no recognition at all. The impact that their existence has on our County can be seen in our economy, in our workforce and in our youth.”

Knight highlighted Campbell Energy’s contributions to We Love White County Inc. (WLWC), a non-profit organization focused on bettering White County, and in particular Jake and wife Keyna’s passion for the WLWC’s Arrows youth empowerment program.

“We Love White County and the Arrows program would not be where it is today without this company and the people behind it,” Knight said. “It is the mission and vision of We Love White County to make our community a thriving place to live by investing in relationships. No one embodies this more than Jake and Keyna Campbell of Campbell Energy. They are invested not just financially in Arrows, but they are committed to loving and helping the people of the program and the people of White County. They are friends and helpers to the people of our community, and they carry this mindset into their business.”

The Campbells were instrumental in providing funds and manpower to renovate the old Brown’s Feed Store on Fifth Street in Carmi into a community youth center.

404 Seed Station Computer Lab

404 Seed Station Game Room

404 Seed Station Entrance/Lobby

“They not only spearheaded a complete renovation, but they themselves put forth much of the man hours required to make the space a warm, inviting and functional space for students and families to grow together,” Knight said. “This location is now known as the 404 SEED Station. Multiple times a week it houses students who are coached along and loved by welcoming adults who offer snacks, homework help, Bible studies, life skills and recreation.”

Campbell Energy was formally founded in 2007 by Jake and his father John Campbell, but the family’s history in the oil industry dates back four generations. The family business – primarily in agriculture prior to 2007 – dates all the way back to the mid 1830s.

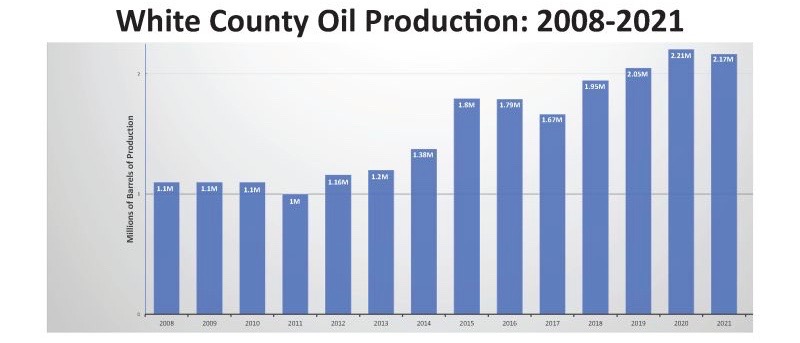

It is largely because of Campbell Energy’s success that White County oil production has more than doubled since 2008.

Not coincidently, ad valorem property tax revenue generated by oil reserves in White County has more than doubled since 2007, with more than 60 percent of the more than $41 million generated during that time-span going to White County schools located in districts with oil production. All of the property tax revenue generated from oil reserves stays local.

Spearheaded by Campbell Energy’s success, the White County oil production and exploration industry directly employs approximately 500 people and generates $224 million in gross regional product per year.

Although Campbell Energy is the largest oil producer in Illinois, it is anything but “Big Oil.” For perspective, ExxonMobil – the largest oil producing company in the United States – produces 900 times more oil per day than Campbell Energy. Saudi Aramco – the largest oil company in the world – produces 2,450 percent more oil per day than Campbell. Likewise, Jake Campbell’s style is anything but “Big Oil.”

“My wife tried to get me to dress better before I left the house this morning,” said Campbell, decked out in an unassuming flannel shirt and blue jeans. “I came straight from a combine here. Collared shirt though, at least.”

Although Jake Campbell and his company don’t put out a “Big Oil” vibe, they are making a big difference in White County and the surrounding areas.

More Than 200 Attend 1st Annual Illinois Basin Celebration

More than 200 Illinois Basin oil exploration and production industry professionals attended the first annual Illinois Basin Celebration at the White County Fairgrounds’ Floral Hall in Carmi on Wednesday, Sept. 7.

The event was organized by the Illinois Petroleum Resources Board (IPRB) to recognize the efforts of the more than 4,000 Illinois Basin oil exploration and production industry professionals and featured a complimentary lunch and presentation by guest speaker Warren Martin of Kansas Strong. Free “Illinois Basin Proud” hats, T-shirts and bumper stickers were also handed out to attendees.

Martin’s presentation focused on the so-called “energy transition,” the essential need for petroleum now and in the future, and the importance of industry advocacy by those who work in the oil and gas industry.

The event also included an IPRB Petro Pros presentation to a group of Gallatin County High School seniors by industry volunteers Mike Payne of Shawnee Oil Company, Ross Basnett of Campbell Energy, Travis Thompson of Travis Thompson Oil Corp. and IPRB executive director Seth Whitehead. Campbell Energy, Franklin Well Services and Jacam Catalyst also displayed various oilfield equipment for the Petro Pros volunteers to show the students.

Local companies provided oil exploration and production industry career information for attendees and the general public. There is currently high demand for almost all of the 75-plus oil exploration and production industry careers, with particularly high demand for truck drivers, electricians, plumbers, welders, roustabouts and various rig and well servicing crew members.

Most of the 200-plus attendees were able to stick around after lunch to pose for the above group photo. Illinois State Sen. Terri Bryant (R-58th District) and State Rep. Dave Severin (R-117th District) were also in attendance for the event and group photo.

Between 10-12 million barrels of oil is produced annually in the Illinois Basin, which includes southern Illinois, southwestern Indiana and western Kentucky.

Illinois oil production alone makes a $3 billion annual economic impact, generating $770 million in yearly personal and business income and $700 million in state and federal tax revenue. More than 30,000 Illinoisans receive royalty income from Illinois oil production, and active Illinois oil leases have generated an average of $7.46 million in local property tax revenue per year since 2007. More than half of that revenue has gone to fund schools near production.

The second annual Illinois Basin Celebration will be held next year in Carmi at the Floral Hall at a yet-to-be-determined date.

The Three Biggest Myths of the ‘Energy Transition’ Narrative

Since passage of the $369 billion climate bill , those who believe we can rely entirely “green” energy have doubled down on claims that these technologies will lower energy costs, make the United States energy independent and eliminate the need for oil altogether. These are the three biggest myths of the “energy transition” narrative.

First and foremost, even the Biden administration’s Department of Energy acknowledges we will need a lot of oil for decades to come.

Why? Because wind and solar replace oil like hats replace shoes. Wind and solar can only generate electricity and provide no alternative to the more than 6,000 modern products made with petroleum, including 70 percent of the typical electric vehicle. Petroleum will also remain essential to the transportation sector far longer than “Keep It In the Ground” activists would like to admit. Not only are electric passenger vehicles far too expensive for most Americans, replacing a fleet of predominantly diesel-fueled trucks that transport more than 70 percent of the goods used in this country would be a monumental task. The same can be said for electrifying the aviation, rail, excavation and maritime sectors. The continued need for oil is one reason why carbon capture – including enhanced oil recovery using carbon dioxide sequestration in oil-producing formations – is such a major component of the climate bill.

Wind and solar also make electricity more expensive for consumers, plain and simple.

When you hear renewable energy proponents claim wind and solar are cheaper than traditional energy, keep in mind they are referring to the cost at the electricity generation source. But what really matters is the cost of electricity to consumers – and wind and solar drive up consumer energy costs because they require nearly 100 percent expensive and redundant backup power from hydrocarbon generation sources or batteries to be reliable. Widespread adoption of electric vehicles will only exacerbate this issue, driving up power demand on a grid that is already overwhelmed.

This explains why electricity costs in “green” Germany have more than doubled since 2000 and were nearly three times higher than the U.S. even before the European energy crisis sent costs into the stratosphere.

Reuters recently reported Germany’s renewable energy mandate “has left Germany with Europe’s highest retail electricity prices and at risk of grid blackouts.” And despite trying to “go green” for 20 years, renewables are able to meet just 15 percent of Germany’s primary energy needs.

Which brings us to the issues of energy independence. Because of the limitations of intermittent wind and solar energy and its refusal to develop its own hydrocarbon resources, the “greenest” country on Earth is the opposite of energy independent. Germany has long been dangerously reliant on Russian oil and natural gas. And in absence of the Russian natural gas since Vladimir Putin invaded Ukraine, Germany has even un-shuttered coal and oil-burning power plants in order to keep the lights on.

And here in the U.S., although sunshine and breezes can obviously be domestically sourced much like our bountiful traditional energy resources, the raw materials for components that collect the energy generated by the sun and wind are currently coming from foreign nations – mostly China. The U.S. has the potential to change the latter, but the same environmental groups that support a rapid energy transition ironically vehemently oppose the domestic mining needed to make it possible. Why? As the New York Times recently reported, “Electric cars and renewable energy may not be as green as they appear. Production of raw materials like lithium, cobalt and nickel that are essential to these technologies are often ruinous to land, water, wildlife and people.”

To be clear, we need all forms of energy, including the alternative variety. But with the various limitations and bottlenecks of wind, solar and electric vehicles noted, it is misleading for “green” energy proponents to insist that we not only won’t need oil and natural gas anymore, but that alternative energy will be cheaper and make us energy independent. Those who have bought into this false narrative will find out soon how misleading it really is.

5 Technologies That Can Dramatically Reduce Environmental Impacts Oil & Gas

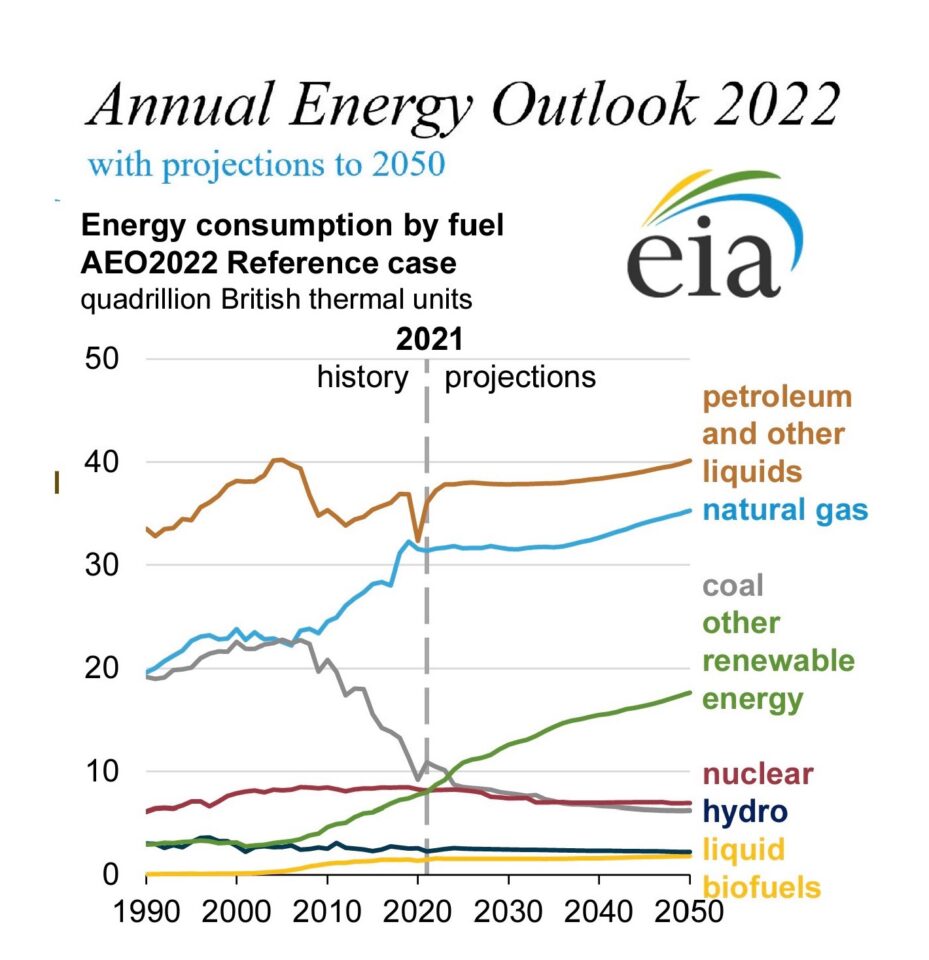

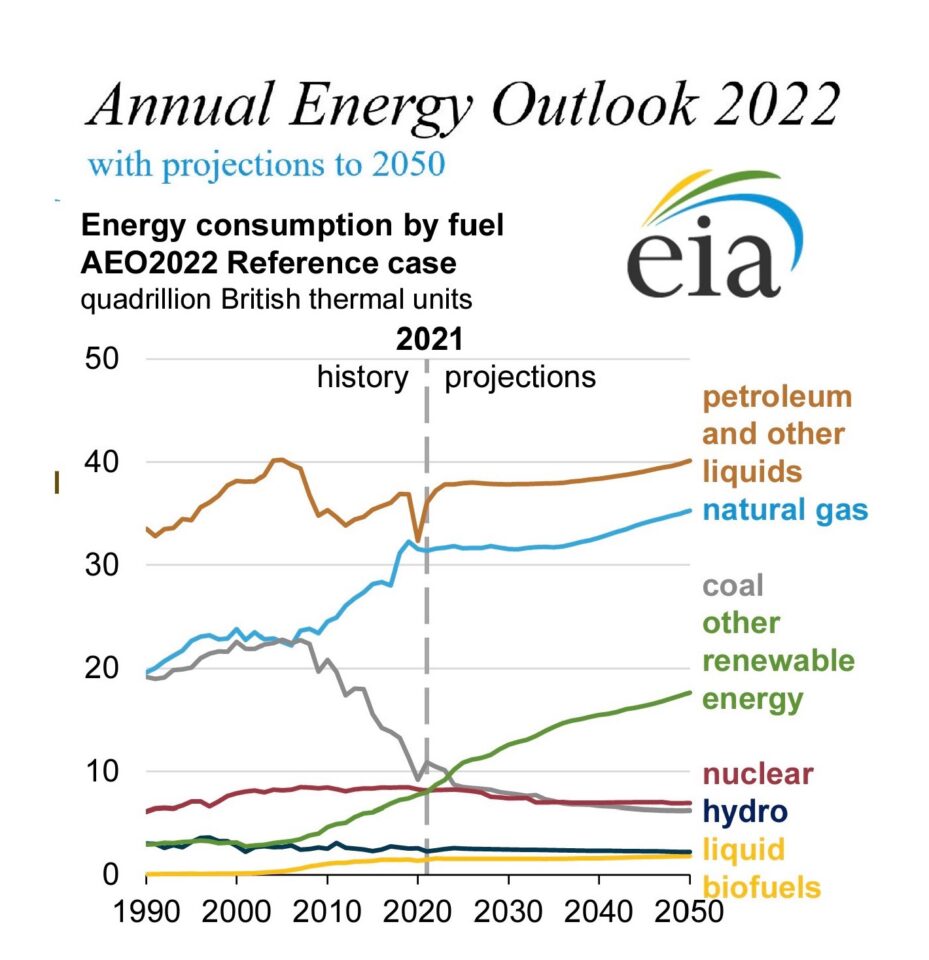

Non-political entities such as the U.S. Energy Information Administration (EIA) have repeatedly confirmed the fact that we will be using a lot of oil and natural gas for many decades to come. In fact, the most recent EIA projections show oil and gas consumption in the United States will actually increase in the coming years rather than decline rapidly.

So, with the reality that we will need a lot of oil and gas for at least the next 30 years in mind, the real question is how can we minimize the environmental impact from hydrocarbon use. Fortunately, a number of technologies have been developed - or are being developed - that will allow us to reduce emissions and protect the environment while continuing to use hydrocarbons to meet our energy and modern product needs. Here are five of the most promising technologies.

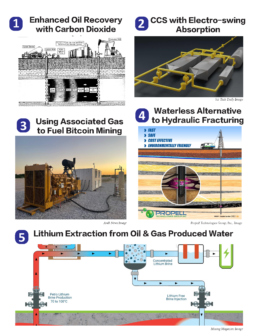

Enhanced Oil Recovery with CO2

Enhanced oil recovery (EOR) using carbon capture and storage (CCS) is a rapidly-improving method of reducing carbon dioxide emissions while also increasing petroleum production. It also has rare strong bipartisan support, increasing the odds of its mass adoption in the coming years. Here’s how EOR with CO2 works.

Carbon capture and storage (CCS) is the direct capture of carbon dioxide from power plants, industrial facilities and the atmosphere.

EOR is a CCS method that involves taking captured carbon dioxide emissions and storing them permanently in underground oil reservoirs, subsequently increasing oil production by pressurizing the formation and “pushing” oil into the wellbore, as illustrated in the following graphic.

EOR using CO2 is currently responsible for 450,00 barrels of oil production per day in the United States and holds the potential to revive mature oil fields such as those most prominent in the Illinois Basin. CCS has also been identified by the United Nations Intergovernmental Panel on Climate Change (IPCC) as being pivotal to reducing emissions and avoiding the worst impacts of climate change. Even the Natural Resources Defense Council (NRDC) has called CO2-EOR a win-win-win for our environment, energy and economy.

Fortunately, a new peer-reviewed study finds there is enough potential underground CO2 storage to meet Paris climate agreement targets. So, if costs continue to fall, EOR with CO2 should be a viable tool to reduce CO2 emissions in the decades ahead.

E&E News also recently reported that a recent Supreme Court ruling will elevate EOR with CO2 as a favored emissions reduction technology. From the E&E News story:

“The Supreme Court’s recent climate ruling means carbon capture will likely form the backbone of any new EPA regulations targeting carbon dioxide emissions from power plants, energy experts and legal analysts said.”

CCS With Electro-swing CO2 Adsorption

A new CCS technology known as electroswing adsorption holds promise to reduce transportation emissions even as use of traditional ICE vehicles continues over the next few decades.

Researchers from the Massachusetts Institute of Technology (MIT) recently published a study detailing how the technology could use a battery-like device to suck CO2 directly from small and mobile emission sources and store it at a relatively low price ($50-$100 per ton of CO2).

The technology could be applied to automobiles and planes, and could also possibly be used for EOR, proving not only to be a key tool in addressing climate change but producing the oil the world will need for decades to come.

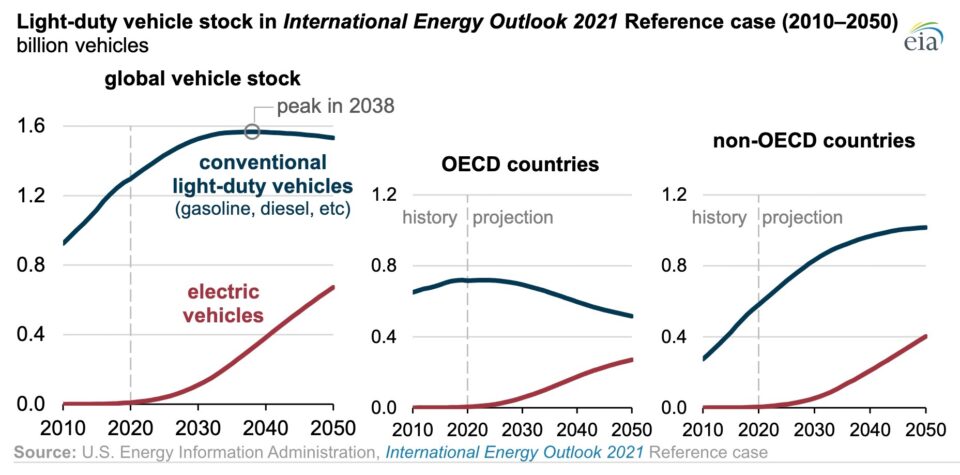

Widespread implementation of electro-swing technology would dramatically reduce the environmental footprint of continued widespread use of ICE vehicles. The EIA projects internal combustion engine (ICE) vehicle use won’t peak until 2038 and that there will actually be more ICE vehicles on the road in 2050 than there are now.

Waterless Hydraulic Fracturing Alternative

Multi-stage high volume hydraulic fracturing (HVHF) of horizontal oil and natural gas wells has elevated the United States to the status of being the world’s leading oil and gas producer. But it also uses a lot of water, which is problematic in arid oil and gas producing states such as Texas and New Mexico.

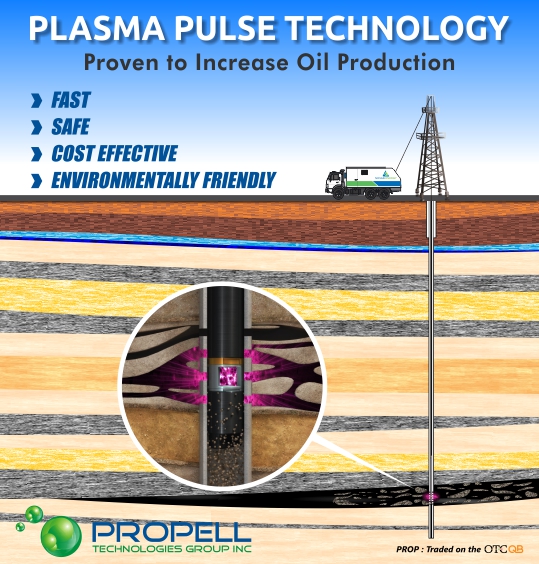

Fortunately, a promising technology known as Plasma Pulse Technology (PPT) shows potential of being a less water-intensive and cheaper alternative to both HVHF and conventional hydraulic fracturing of vertical wells.

PPT produces a high-pressure plasma pulse in the target pay zone via a powerful electrical discharge. A compression shock wave then propagates along the path of least resistance over long distances.

In a well that has previously been hydraulically fractured, the first two or three pulses clean existing perforation. The subsequent pulses then penetrate into the reservoir and create new micro-cracks that allow oil and gas to flow more readily into the wellbore.

Forbes recently reported that PPT is 75 percent cheaper to conduct on the traditional vertical wells most prominent in the Illinois Basin than conventional hydraulic fracturing. It looks to be ideal for re-fracturing existing wells but could replace hydraulic fracturing altogether in the coming years.

Using Associated Natural Gas to Fuel Cryptocurrency Mining

The capturing of associated natural gas produced along with oil at production sites and using that gas to fuel cryptocurrency mining is already proving to be an effective means to reduce flaring.

Not only does this practice reduce energy waste and emissions from flaring, it also reduces the carbon footprint of the highly energy-intensive process of cryptocurrency “mining” – which is actually a process of engineers and computers running complex math problems to access cryptocurrency at data centers.

The associated natural gas that would otherwise be flared due to the lack of gathering infrastructure at remote oil production sites is instead a captured to produce electricity for the “mining” process at data-centers located near the production sites.

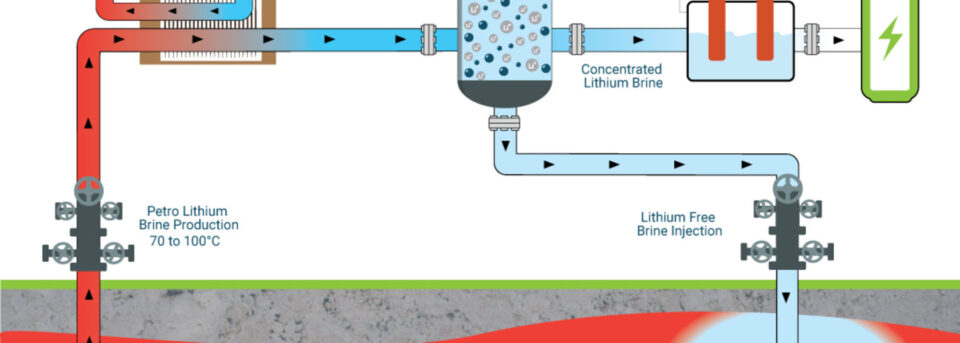

Lithium Extraction from Produced Water

The push to electrify everything with electric vehicles and renewable energy technologies such as wind and solar is expected to increase global lithium demand up to 2,000 percent. The mineral is necessary to produce batteries for these technologies and the United States currently accounts for less than one percent of the world’s lithium due to vehement environmental group opposition to domestic mining.

However, co-produced brine from oil and gas production contains lithium and it could potentially be extracted from this otherwise useless byproduct of oil and gas production.

Natural Gas Intelligence reports, “Recovering commercial volumes of lithium from the oil and gas byproduct would bolster the United States’ domestic supply of the valuable mineral, but it won’t be easy.”

The University of Louisiana-Lafayette’s Daniel Gang, director of the Center for Environmental Engineering and Protection adds: “Mining lithium requires a highly selective recovery technology, extracting just the lithium from produced water. The technology is still in the benchtop-laboratory or pilot scale.”

Though challenging, figuring out a way to extract lithium from produced water would prove more ideal than relying on China for the metal. China has a near global monopoly on mining of cobalt, lithium and rare earth elements that are essential to producing the solar panels, wind turbines and batteries needed to capture energy generated by the sun and wind. China also controls more than 50 percent of world’s lithium processing.

Just as importantly, the technology could reduce the need for unprecedented and carbon-intensive mining – a win-win for the environment and our energy security.

Conclusion

It is often assumed that continued hydrocarbon use is synonymous with increased greenhouse gas emissions and other environmental impacts. But the fact remains that we will need to use oil and natural gas for many years to come, and fortunately a number of technologies are being developed that can allow us to protect the environment while using the traditional energy sources we need.

Energy Security Only Possible With an All-of-the-Above Approach

One of the more ludicrous claims to gain traction since Russia’s invasion of Ukraine fast-forwarded an already inevitable energy crisis is that simply going “green” can secure our energy independence. This is an ironically-flawed notion that ignores some inconvenient truths our European allies know all too well.

Though we obviously don’t rely on foreign nations for sunlight and wind, we are almost completely reliant on other countries (mostly China) for the immense quantities of minerals and materials needed to build the wind turbines, solar panels and batteries used to collect “green” energy. This is primarily because the same “Keep It In the Ground” groups that insist we go 100 percent “green” have proven very effective at stopping the domestic mining needed to access these raw inputs here in the United States. Add in the fact renewable energy can only generate electricity – weather-dependent and unreliable electricity at that – and it’s clear wind and solar replace oil and thousands of petroleum-based products about as well as hats replace shoes.

It is with these facts in mind that the Department of Energy has repeatedly forecast we’ll need more oil and natural gas 30 years from now than we’re using today.

That said, the only realistic path toward energy and economic security is an all-of-the-above approach that focuses on producing as much of all forms of energy in the United States as possible.

Fortunately, we are in a much better position to truly embrace an all-of-the-above approach than our friends in Europe. Europe has spent the past 20 years shunning development of its hydrocarbon resources and attempting to go “green.”

So how’s it going?

Because of its obsession with going “green,” a vast majority of European countries banned hydraulic fracturing (aka “fracking), the most effective technology available to maximize oil and gas production. “Fracking” has single-handedly transformed the United States into a net petroleum exporter over the past 15 years and it is now used to complete 95 percent of new oil and gas wells in the U.S. At the same time, European oil and gas development has declined rapidly while renewable energy has proven woefully inadequate for meeting Europe’s energy demand. As a result, the continent has relied on Russia for 40 percent of the natural gas and 25 percent of the oil it consumes.

After bankrolling Vladimir Putin’s atrocities in Ukraine to the tune of $450 million per day in Russian oil imports as it dilly-dallied for months on a decision to ban Russian petroleum, Europe is now scrambling to find a replacement for the oil it desperately needs. Its leaders’ proposed solution: more renewables. As one industry insider recently tweeted, Europe has painted itself in a corner and is contemplating using more paint.

We must learn from Europe’s mistakes and avoid their unrealistic “green” energy fantasies that have turned into an energy nightmare. There are no shortage of red flags on the misguided path to relying on foreign nations for alternative energy.

Stellantis CEO Carlos Tavares recently warned that the electric vehicle (EV) industry is facing a “Darwinian period” due to difficulty in acquiring essential mineral inputs for massive EV batteries. Environmental groups also recently successfully lobbied the Biden administration to give China a two-year pass on solar component tariffs. Why? Because they know U.S. manufacturers don’t have the supply chains needed to fill a void that a sudden halt in Chinese imports would create.

President Bien has invoked the Defense Production Act in an effort to increase the domestic supply of minerals. But his own Department of the Interior recently killed a major nickel and copper mine in Minnesota after being pressured by environmental groups. In a comment widely trumpeted by “green” groups for years, Earthjustice senior legislative representative Blaine Miller-McFeeley said, “We do not need more dirty mining to achieve the clean energy transition.”

But in reality, all forms of energy and modern products originate from the ground and we will need more mining, drilling and other forms of energy development to meet our ever-growing needs. That is why an all-of-the-above energy approach focused on domestically-produced oil, natural gas and alternative energy is the only realistic way of ensuring our energy security and any hopes of energy independence. Simply going “green” won’t cut it.

What to Know About New EDF Marginal Well Methane Study

The Environmental Defense Fund (EDF), an environmental group that has long lobbied for federal regulations on methane emissions from marginal oil and gas wells, released a study last week that claims low-producing wells are responsible for roughly half of the fugitive methane emissions from U.S. oil and gas production sites.

The study’s topline finding contradicts the Obama administration’s 2015 statement that methane emissions from marginal wells are “inherently low” and a draft Department of Energy (DOE) study that supports that conclusion.

Nonetheless, the new EDF study received widespread media coverage while the DOE study has received virtually no attention.

Why? Mainly because the final version of the Department of Energy study, originally slated to be released in late 2021, has been stalled in the peer-review process since last December. In the meantime, the Biden administration has released its new methane rules, the draft version of which largely exempts marginal wells. However, the public commenting period is ongoing and - not surprisingly - EDF has released a peer-reviewed report of its own. The group expects the Biden administration’s Environmental Protection Agency to utilize the study in finalizing its new methane rules. As S&P Global Platts reported:

“On a call with reporters to discuss their new study, EDF scientists said the agency [EPA] has indicated it may expand inspection mandates to such [marginal] wells in a supplemental rulemaking this summer.”

The contrasts between what the EDF study asserts and what the preliminary DOE study found are not subtle.

The new EDF study, which is based on measurements from six of EDF’s previous studies on oil and gas production site methane emissions covering at total of 240 marginal producing sites, claims methane leakage rates from marginal wells exceed 10 percent of overall production. The new EDF study states:

“Most low production well sites (75%) have detectable site-level CH4 emissions of up to 5kg CH4/h (Fig. 3).”

The six studies utilized for the new EDF study also used downwind, site-level measurements that did not allow for methane emission source attribution and did not involve any operator participation. The latter goes against Academy of Sciences recommendations. The new EDF study states:

“We focus on site-level measurement studies, performed using ground-based downwind measurement approaches that do not require operator-provided access to measured sites and can resolve total CH4 emissions at each measured site, but generally do not resolve source-specific emissions (Methods).”

Unlike the EDF studies, the DOE study was conducted, with only one exception, directly on oil and gas production sites. The study was also conducted with the full cooperation of operators, using random sampling to select sites, while also giving no more than 24-hour notice to operators that measurements were being taken. The following photographs and captions are included in the draft DOE report.

And, unlike the new EDF report, the draft DOE report includes measurements from several Illinois Basin oil production sites. Notably, Illinois Basin oil wells produce very little associated natural gas.

Among the most notable takeaways from DOE study field campaign that included the Illinois Basin were:

- 75 percent of the 87 oil sites evaluated had no detected emissions at all

- 90 percent of observed emissions were less than 13 standard cubic feet per hour

- 95 percent of the observed emissions were less than 25 scfh

- 90 percent of emissions detected were from 12 percent of the sites

- Two sites – an oil well that had a sucker rod packing issue on its pump jack (137 scfh) and a natural gas well with an open hole in the wellhead casing (156 scfh) – accounted for 40 percent of the overall emissions detected

Unfortunately, it is unclear as to whether the DOE study will be finalized in time to be considered by the EPA in its rule finalization process this summer. When completed, the DOE study will provide the most definitive marginal well methane emissions profile to date.

Some who have been following the methane emission debate might recall the fact that there was previously no significant research on marginal wells sufficient enough to justify methane rules on marginal wells – that was the impetus for the DOE study in the first place. EDF claims that its new study fills that gap. But that claim is highly debatable at best and the study warrants some serious scrutiny.

It’s Time For Energy Reality to Take Center Stage

When it comes to energy, rhetoric sure seems to get a lot more attention than reality.

If many politicians and media outlets were to be believed, the “green” energy transition is just around the corner and the permanent cancellation of our hydrocarbon fuel-driven society is imminent. But in reality, we are going to need even more traditional energy sources such as oil and natural gas than we are currently using in the decades to come. And it’s not just the fossil fuel industry making that assertion.

The Biden administration’s own Energy Information Administration (EIA) contradicts its boss’s energy narrative in its latest annual energy outlook, noting that petroleum and natural gas will likely be used in higher quantities than they are today nearly three decades from now and will remain the United States’ leading energy sources through at least 2050.

That is not a misprint. EIA deputy administrator Stephen Nalley even said plainly during the report’s rollout, “We do not see liquid fuels and natural gas losing their place as the top two sources of energy in the US to 2050. That appears to be true under a pretty wide variety of assumptions about economic growth, technology and energy development costs and prices.”

Why has the EIA consistently reached this conclusion over the past several years? Because as a non-political entity, it has to take into account the reality that a sudden switch to reliance on weather- and foreign mineral-dependent technologies for all of our electricity and transportation needs simply isn’t feasible.

Throw in the fact that that 40 percent of the world’s oil consumption can be attributed to making everything from “mascara to medical devices,” as NBC News recently reported, and it’s clear that reality should take precedent over rhetoric when it comes to policies concerning our domestic oil and natural gas supply.

The current crisis in Europe provides the ultimate reality check and a prime example of a model the United States needs to avoid. Germany, the European Union’s largest economy, has been doing everything in its power to cancel oil and natural gas for the past 20 years. So how is it going?

Germany’s taxpayer-funded renewable energy push known as “Energiewende” has left it with the highest retail electricity costs in the world. A recent IEEE Spectrum report also concluded, “Without anything like the expensive, target-mandated Energiewende, the United States has decarbonized at least as fast as Germany, the supposed poster child of emerging greenness.” And despite all of its “green” policies, petroleum remains Germany’s leading source of energy. Where does Germany get most of its petroleum? You guessed it – Russia. Same story for its natural gas supply.

The fundamental need for oil and natural gas can explain why even Tesla founder Elon Musk is realistic about the need for the United States to produce as much of both as possible within its borders. Musk recently tweeted, “Hate to say it, but we need to increase oil and gas output immediately. Extraordinary times demand extraordinary measures.” Musk also stated in a December interview that, “The reality is, if we didn’t have oil and gas right now, civilization would collapse and everyone would be starving. So, we also need oil and gas right now. It would be absurd to just stop it. It’s not feasible.”

As Musk is likely aware, widespread EV adoption will require massive increases in mineral mining for batteries and other components. China currently enjoys a virtual monopoly in mineral mining, processing and manufacturing of components necessary for solar panels, wind turbines and EVs. This explains why simply “going green” won’t result in energy independence any time soon. With those supply-chain issues in mind, the aforementioned EIA report notes that despite all the hoopla about EVs, gasoline-powered vehicles will likely represent 79 percent of new personal vehicle sales by 2050 and internal combustion engine vehicles won’t peak until 2038.

Though striving to improve our energy sources remains a noble quest for the future, we must focus on the reality of the present moment. We will need oil and natural gas for many decades to come and it is best to produce as much of it here in the United States as possible to avoid the dependence that is threatening the security of Germany and our other European allies.

Illinois Oil Producers Have No Control Over Pump Prices

The following was published as a guest column in the Alton Telegraph, Centralia/Mt. Vernon Sentinel, Kankakee Daily Journal and Villagers' Voice.

As gasoline prices soar to unprecedented levels, the narrative that oil companies are price gouging at the pump is becoming quite prevalent. But as Politico recently reported, though many are blaming oil companies for high prices, “the facts don’t back them up.”

Facts are indeed a stubborn thing.

Fact: the Federal Trade Commission, state attorneys general and consumer groups have spearheaded hundreds of lawsuits and investigations into alleged oil company price gouging and have turned up zero evidence that any coordinated manipulation of oil markets has taken place.

Fact: oil companies – and particularly the small, independent producers most prevalent here in Illinois – have absolutely no ability to control prices. If they did, they certainly would have never allowed oil prices to go negative in April 2020.

Fact: Crude oil and gasoline, the latter a refined petroleum product, are globally traded commodities and their prices are determined by global supply and demand.

At the moment, global demand is soaring toward all-time highs while supply has been limited by a decade of underinvestment in new drilling, a phenomenon that has been fueled by both government policies and the hydrocarbon divestment movement. These are the primary reasons why oil and gasoline prices are so high and likely will remain high for some time. The ban of Russian energy imports by several nations and private companies has only made an already bad supply/demand imbalance worse.

Here in Illinois, where there are no publicly traded companies producing oil, our small independent operators are typically three layers removed from the gasoline and diesel that is eventually purchased by consumers. A vast majority of Illinois oil producers sell their crude oil to midstream companies commonly known as first purchasers. The price oil producers receive from the sale of their crude to first purchasers is based on the posted domestic West Texas Intermediate price at the time of the sale, with a transportation and storage fee deducted from that base price. The first-purchaser then sells the crude oil to a refinery. Following the conversion of that crude into fuels, refineries eventually sell gasoline and diesel to a petroleum marketer. The finished product is then sold to services stations that ultimately determine the pump price.

So next time you’re driving by a gas station and feel compelled to curse at the sky-high price posted on the sign out front, please consider sparing Illinois oil producers from your ire.

The fact of the matter is, the world still runs on oil and will for decades to come. A vast majority of our transportation fuels are petroleum-based. In addition to our personal vehicles, more than 70 percent of all goods shipped in the U.S. are transported by predominantly diesel-powered trucks. And as NBC News recently reported, 40 percent of the world’s petroleum demand “can be found in everything from mascara to medical devices” in the more than 6,000 petroleum-based products that we use every day.

That’s why even Tesla CEO and founder Elon Musk has acknowledged that “we need to increase oil and gas output immediately” and “civilization would collapse and everyone would be starving” if we eliminated oil and natural gas right now.

The Biden administration’s Energy Information Administration (EIA) even projects we will not only need oil and natural gas decades from now – but that we’ll actually need more than we are currently using by 2050. As EIA Deputy Administrator Stephen Nalley recently said, “We do not see liquid fuels and natural gas losing their place as the top two sources of energy in the US to 2050. That appears to be true under a pretty wide variety of assumptions about economic growth, technology and energy development costs and prices.”

Bottom line – lowering pump prices and energy costs won’t be as simple as everyone just buying an electric vehicle. We must develop as many domestic energy resources as possible with the knowledge that our economic and national security depends on it. Anyone who doubts that fact need only look at Europe, which is dealing with sky-high energy costs while relying on Russia for a quarter of its crude oil and 40 percent of its natural gas imports.