Three Reasons Illinois Gasoline Prices Didn’t Crash Along With Oil Prices

UPDATE: May 13, 2020, 3:25 p.m. CDT

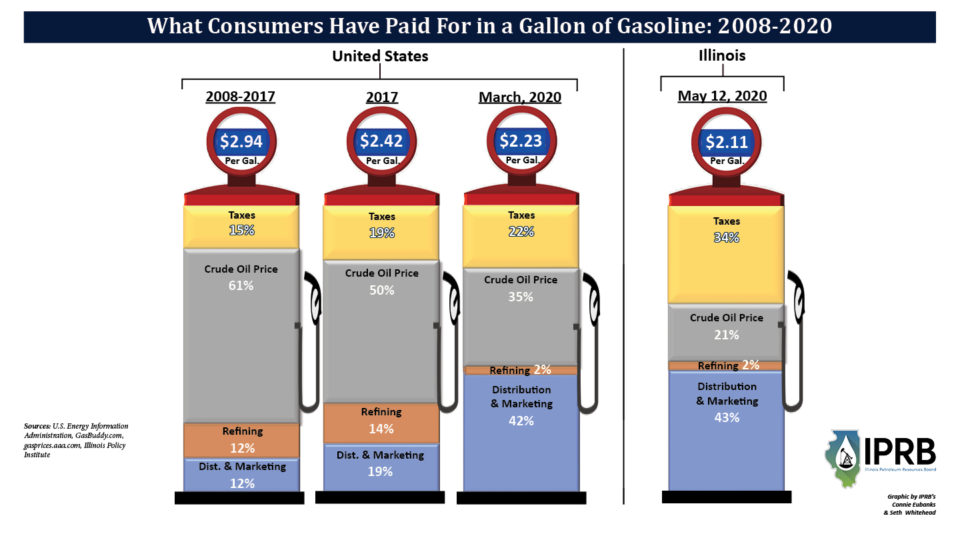

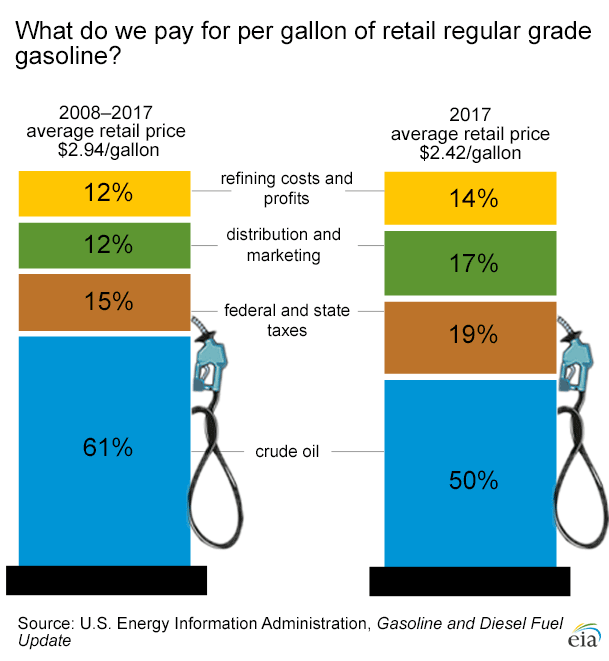

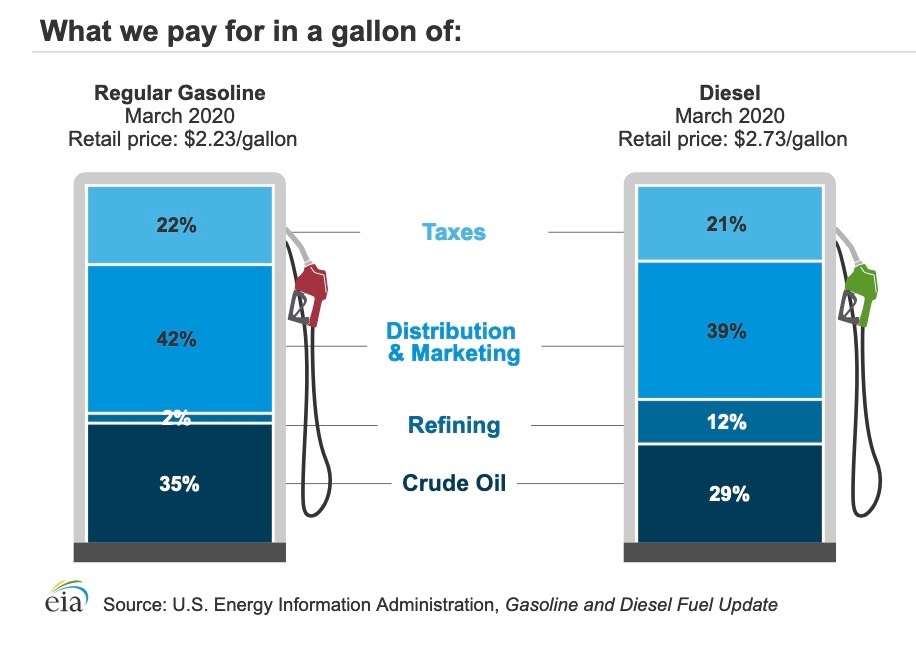

Data released this week by the U.S. Energy Information Administration show that 64 percent of the retail price of a gallon of gasoline across the country in March could be attributed to taxes and marketing and transportation costs. As the following IPRB graphic shows, pump prices attributable to taxes and marketing and transportation costs has increased significantly over the past 12 years, while the share attributable to oil prices and refining costs have declined. The trend is even more pronounced in Illinois, where 77 percent of the price at the pump on May 12 could be attributed to taxes and marketing and transportation costs.

Editors Note: Original blog published on May 7, 2020, was updated on May 13, 2020, with new supplementary information from the Energy Information Administration

In the wake of the recent oil price crash that resulted due to the demand shock created by the coronavirus pandemic, many Illinois consumers may be wondering why gasoline prices haven’t declined as sharply as the price of oil did.

Though the average Illinois retail gasoline price sat at $1.79 per gallon on April 29 – the lowest average Illinois pump price in recent memory – it was still well above the average cost in many neighboring states.

Here are three reasons Illinois pump prices haven’t necessarily reflected extremely low domestic oil prices over the past few weeks.

Reason #1: High State Taxes

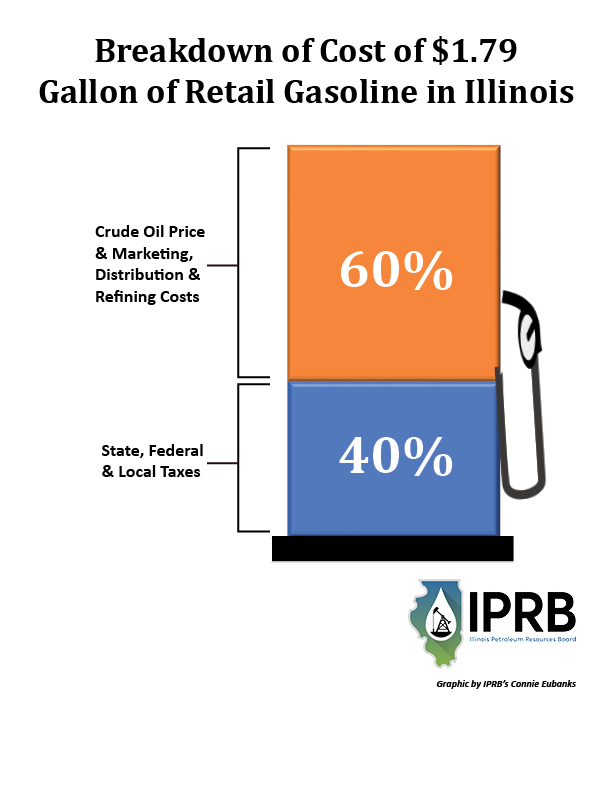

State, federal and local gasoline taxes in Illinois total 72 cents per gallon combined (and even higher near Chicago), meaning that roughly 40 percent of Illinois pump prices in late April were attributable to taxes.

Illinois’ state gasoline tax doubled last summer from 19 to 38 cents per gallon and is now the third highest state gasoline tax in the country. That total piles onto the 18.4-cent per gallon federal excise tax and 15-to-17-cent per gallon of local taxes paid by Illinois drivers. So no matter how low the price of oil goes – and it went as low as it could go on April 21 – retail gasoline prices in Illinois could fall no lower than 72 cents per gallon.

Reason #2: Global Crude Standard Drives Pump Prices

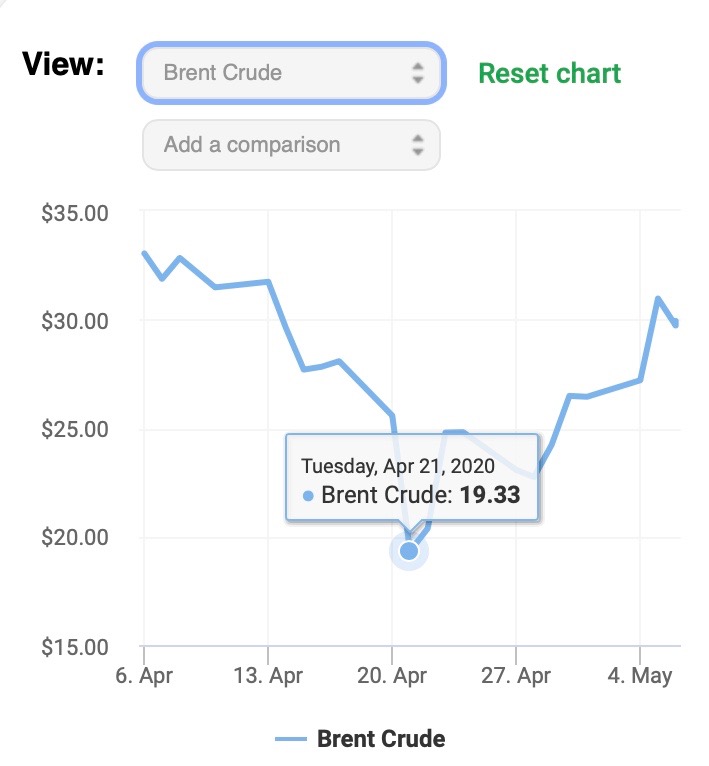

Another reason Illinois gasoline prices didn’t completely crash when the domestic oil price standard – the West Texas Intermediate (WTI) – went below $0 on April 21 is because refined products such as gasoline are traded on the world market and are determined by global market prices, namely, the global Brent crude index.

As the following Oilprice.com chart shows, though the Brent price dropped dramatically on April 21, it came nowhere close to the freefall the WTI experienced.

Brent prices have also remained higher than the WTI standard throughout the COVID-19 pandemic, continuing a trend that has generally been observed in recent years.

Notably, U.S. crude exports have kept Brent prices – and, by extension, pump prices – lower than they otherwise would have been by adding supply to the global market and thwarting OPEC’s once tried-and-true efforts to keep prices artificially inflated.

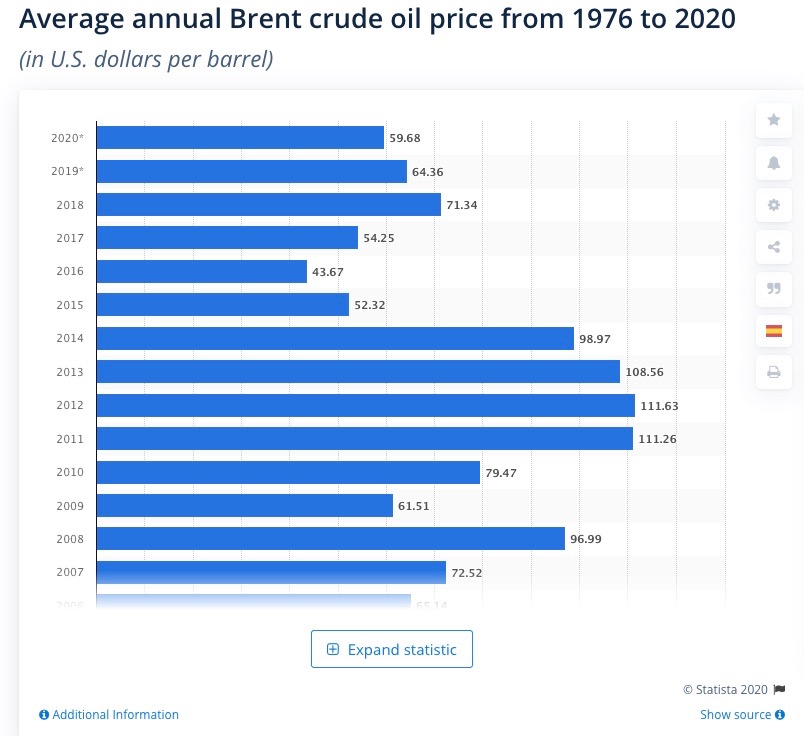

Prior to the U.S. oil production renaissance that has been ongoing for the few years, Brent oil prices averaged nearly $100 in 2008 and remained near that level through 2014. Not coincidentally, gasoline prices were routinely over $3 a gallon during that time, and went over $4 a gallon in 2011.

But after the crude export ban was lifted in 2015, Brent oil prices declined dramatically, driving down the overall cost of gasoline and the share of retail gasoline costs attributable to oil prices, as the following Energy Information Administration graphics illustrate.

As the latest EIA graphic shows, global oil prices represented just 35 percent of the total cost of gasoline across the nation in March, compared to an average of 61 percent from 2008 to 2017.

Reason #3: Refining, Transportation and Marketing Costs Part of Equation

The third factor that explains why pump prices didn’t bottom out completely along with domestic oil prices last month are the necessary refining, distribution and marketing costs that are included. Marketing and transportation costs have ranged between 25-42 percent of pump costs from 2008 to the present.

Notably, local refining can reduce the cost of transporting gasoline to the market, reducing prices at the pump as well. The latest EIA data show that refining costs have declined dramatically since 2017 along with crude oil prices, while taxes and marketing and distribution costs have grown sharply.

Conclusion

The fact that the United States has emerged as the world’s top crude oil producer and a major exporter explains why the average American household has paid $500 a year less for gasoline each year since 2014. As USA Today recently reported “$3-a-gallon gasoline is becoming a distant memory” and “the main reason is the nation’s oil boom.” But the fact that gasoline taxes have generally increased – especially in Illinois – is the primary reason pump prices haven’t dropped even more. Essentially, increased taxes and marketing and transportation costs are the primary reasons why $1-a-gallon gasoline – even when the price of oil hits rock bottom – are a distant memory as well.