Illinois Oil Reserves Generated $4.3M in Property Tax Revenue in 2018

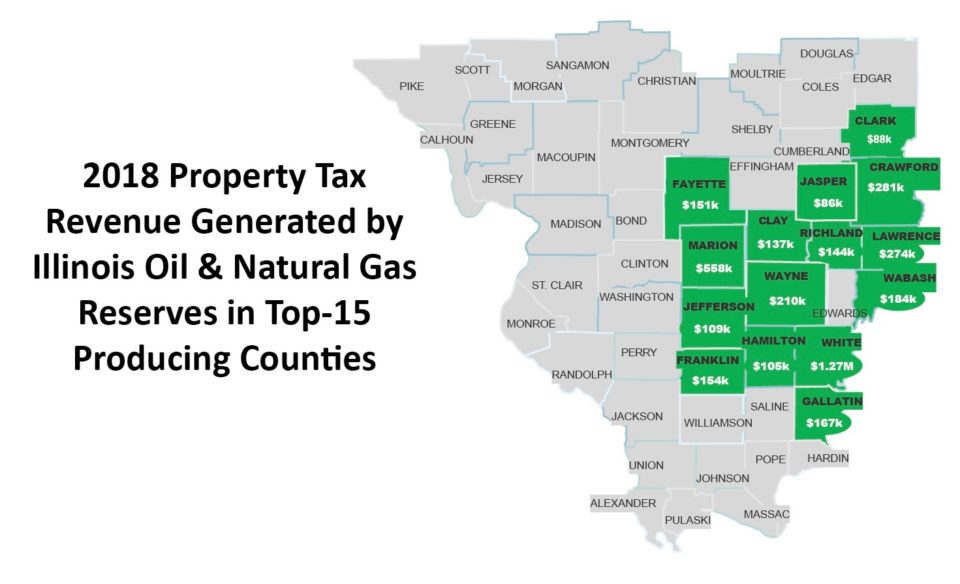

Recently posted Illinois Department of Revenue (IDOR) data show that Illinois oil and natural gas reserves generated more than $4.3 million in property tax (ad valorem) revenue in 2018. Of that total, more than $3.9 million was generated in Illinois’ top-15 oil producing counties, where 90 percent of the state’s oil production occurs.

All of this revenue stayed at the local level and more than half went to fund K-12 public schools in the counties in which oil and natural gas reserves are located. That fact considered, IPRB conservatively estimates that at least $2.15 million of this revenue went to fund K-12 education in producing counties, including $1.95 million in the top-15 producing counties.

The rest of the $4.3 million in revenues went to fund county governments, road and bridge projects, local townships, local community college districts, public libraries, local hospitals, fire departments and park districts in producing counties.

Notably, oil and natural gas reserve property tax revenue collected in 2018 is based on 2017 assessments of active leases using 2016 production totals and average price of oil over a two-year period prior to the assessment date. The assessments are also based on estimated reserves that remain in the ground, not production. There are also assessment reductions for leased oil and natural gas reserves based on age, secondary recovery and methods of production.

A previous IPRB report released in the summer of 2019 finds Illinois oil and natural gas reserves generated more than $89 million in revenue from 2007-2017. Find out more about that report here.

2019 oil and natural gas reserve property tax revenues are not yet available on the IDOR website.